Stocks finished mostly lower, with the equal-weight Invesco S&P 500® Equal Weight ETF (NYSE:) down about 60 bps, while the market-cap-weighted index closed flat. Today kicked off what should be an eventful week, but so far, there’s not much to talk about.

The Treasury announced it plans to rebuild the TGA to $850 billion by the end of both September and December, signaling that Bessent & Co. isn’t looking to shake things up—for now.

The Treasury also expects to borrow just over $1 trillion this quarter—$453 billion more than projected in April. Next quarter, it plans to borrow an additional $590 billion, still targeting a TGA balance of $850 billion. On Wednesday morning, we’ll learn how they intend to finance all this borrowing, with most expecting the bulk to come via T-Bill issuance.

Rates were largely unmoved. Even the 30-year yield rose modestly, up 3.5 basis points to 4.96%.

But more importantly, this will allow the TGA to be replenished, which should ultimately result in lower reserve balances held at the Fed and lower liquidity levels.

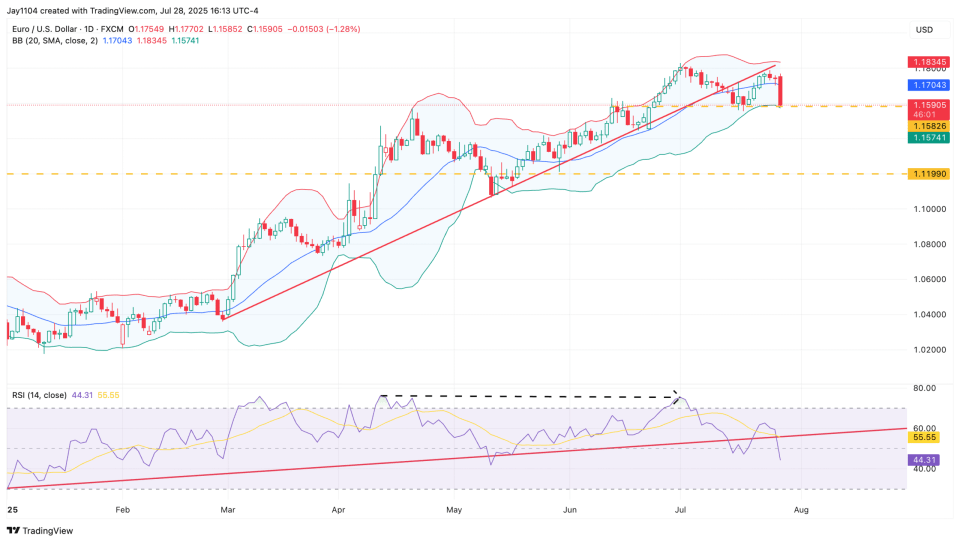

The biggest move today came in FX, with the dollar strengthening—particularly against the euro—after the trade deal announcement, which appeared to heavily favor the U.S. Whether the EU chooses to accept the agreement is another matter, as it still requires approval by member states.

The biggest move today came in FX, with the dollar strengthening—particularly against the euro—after the trade deal announcement, which appeared to heavily favor the U.S. Whether the EU chooses to accept the agreement is another matter, as it still requires approval by member states.

is teetering on the edge of a breakdown, sitting just above key support at 1.159. The uptrend has already failed, and momentum, as measured by the Relative Strength Index, has also rolled over. A break of support likely opens the door for a move lower, potentially down to 1.119.

A stronger dollar will also work to reduce liquidity in the market, since most measures of “global liquidity” are just dollar proxies.

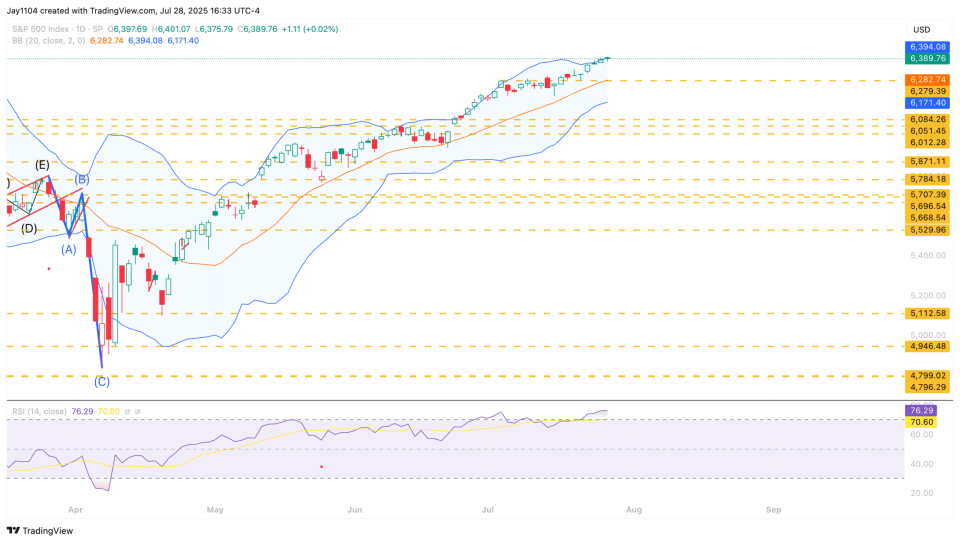

In the meantime, stocks just churned with little real movement. The remains overbought, with an RSI above 70 and the index trading above its upper Bollinger Band. While it’s possible for the index to stay overbought for an extended period, several factors—such as low realized volatility, tightening liquidity conditions, and a stronger dollar—suggest these conditions may not persist much longer.

In the meantime, stocks just churned with little real movement. The remains overbought, with an RSI above 70 and the index trading above its upper Bollinger Band. While it’s possible for the index to stay overbought for an extended period, several factors—such as low realized volatility, tightening liquidity conditions, and a stronger dollar—suggest these conditions may not persist much longer.