The IPO floodgates have swung open for breakthrough AI and crypto companies ready to shake up the market

Figma’s debut joined CoreWeave and Circle in a rollercoaster ride of quick gains and sharp dips

A fresh name hits the trading floor this week as investors scout the next IPO winners

Bullish is set to IPO this week. It’s a Cayman Islands-based crypto exchange seeking to raise more than $600 million, according to an SEC filing earlier this month. A sign of the times? Perhaps. It’s enough to make contrarian investors’ ears perk up, given the name. After a handful of successful go-public story stocks this year, the firm led by CEO Tom Farley, a former president of the New York Stock Exchange, has a lot to live up to.

Figma’s Volatile Debut Joins CoreWeave and Circle’s IPO Rollercoaster

Circle (NYSE:) is the big IPO winner so far this year, returning 418% from its first day of trading, while AI player CoreWeave (NASDAQ:) sports a 173% gain since it listed in early June. The latest IPO craze surrounds Figma (FIG), a browser-based designing interface company, which brought about mid-late 1990s vibes when it began trading in July.

But is the shine coming off the 2025 IPO Cinderella story? CRCL was cut in half from its June peak to below $150 for a time last week, CRWV dropped 55% over the early summer, and FIG fell hard after an early burst. Still, the Renaissance IPO ETF (NYSE:), which holds shares of recent IPOs, notched fresh highs going back to Q1 2022 as August got underway.

IPO Window Opens…In Some Spots

It’s clear that the IPO environment is more conducive than it was a few quarters ago, but there’s still uncertainty for currently private companies considering testing the public waters. Sure, it’s high times for AI and crypto adjacent going concerns, but companies in other, more cyclical industries may still be treading lightly.

Recent and Purchasing Managers Index (PMI) readings have not been all that upbeat, while earnings growth away from the Magnificent Seven stocks is paltry. Thus, the story with IPOs mirrors what we see in most of the US stock market: Party on in tech (AI and crypto, specifically) and good luck to everyone else, particularly domestic small and mid-sized companies.

Space startup Firefly Aerospace (NASDAQ:) hit the tape last week on Thursday August 7th, and it aims for more durable success than Voyager Technologies (NYSE:), which popped and dropped after its June IPO.

Bullish’s IPO Follows Figma’s Pricing Challenges

What happens this week with Bullish (which trades under the ticker BLSH) will be the latest data point on the broader trend. Pressure was undoubtedly on its underwriters in the wake of Figma’s pricing. FIG priced at $33, opened at $85, then peaked on its second session at $142. Its market cap topped out near $70 billion, which (at the time) made it larger than 340 constituents.

You see, when a stock is priced significantly below its post-IPO trading level, many experts argue that substantial money was “left on the table.” Had the underwriting banks set a higher price, original investors might have enjoyed even greater gains. Instead, the quick profits went to new shareholders who bought in at the IPO price.

Increasing IPO Filings Signal a Gradual Market Recovery

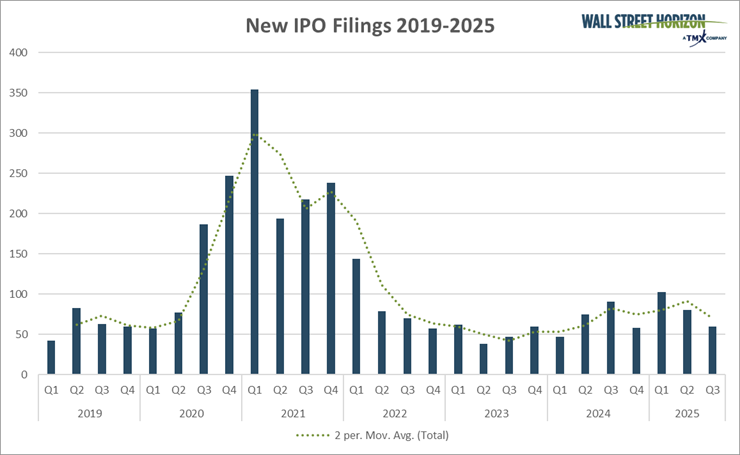

Bigger picture, there remains a clear, though gradual, upward trend in the number of new IPO filings. The count (on a trailing 12-month basis) hit a low in Q1 2024, and we’ve seen modest year-over-year increases since then. Not even halfway through the third quarter, and we have already reached about 70% of the total IPO filings for Q3 2024. All the while, high-profile private companies bide their time, surely eyeing that perfect moment to tap the public arena.

IPO Count Gradually Recovering Since Early 2024

Source: Wall Street Horizon

Predicting the Next Big IPO: Klarna and Other Contenders

Who might be next? There’s an online prediction market for that. According to Kalshi, bettors place an 81% chance that Klarna, a Swedish fintech company specializing in the buy now, pay later niche, will IPO by the end of the year. The latest reports suggest Klarna will restart its public offering process as soon as September.

SpaceX, OpenAI, and Anthropic Await Market Debuts

Discord, Cerebras, and Databricks are other possible IPOs as we approach the end of 2025, but the real heavyweights to come are SpaceX, OpenAI, and Anthropic. Valuations run in the hundreds of billions of dollars for those private behemoths, with higher estimated price tags every time a funding round happens, it seems. Wall Street bankers are no doubt champing at the bit to organize IPO roadshows, while Elon Musk and Sam Altman could capitalize on ever-increasing valuations.

Macro Conditions and M&A Activity Influence the Broader IPO Market Outlook

As for the ex-tech space, it may take time for macro conditions to turn more favorable for IPOs to flourish. Lower interest rates would help spur equity unlocks, so long as a protracted economic downturn is avoided. Our team will also be watching M&A trends as a potential first step toward a pickup in cyclical-sector go-public activity.

The Bottom Line

With so many massive day-one IPO winners, casual investors might think the IPO market is as hot as ever. That’s not the case when eyeing the data. Still, capital markets are stronger compared to recent years, and the IPO pipeline is filled with AI and high-tech power players.