Current Technical Landscape

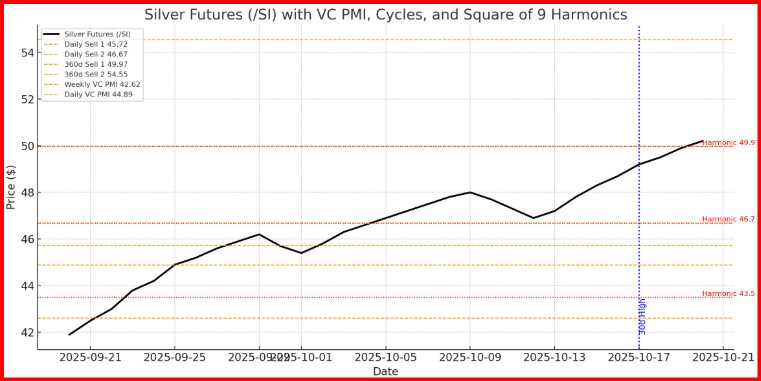

futures (/SI) are trading at $45.76, surging +1.56% in the pre-market session. The market has broken decisively above both weekly resistance pivots ($43.77–$44.27) and is now consolidating above the daily VC PMI ($44.89). Price is pressing into Daily Sell 1 ($45.72), with upside momentum aligning toward Daily Sell 2 ($46.67). This confirms that buyers have taken control, and the market is signaling a continuation phase.

Volume spikes and intraday momentum confirm accumulation, while the MACD, though still negative, is curling upward—suggesting the onset of a momentum crossover that could fuel the next leg higher.

VC PMI Framework

- Weekly Mean ($42.62) has now become the major reversion support. Holding above this level shifts probability toward retesting upper fractals of the weekly range.

- Daily Mean ($44.89) is the short-term fulcrum. As long as the market holds this pivot, the bullish trend remains intact.

Profit-taking Zones:

- $45.72 (Daily Sell 1) → first distribution level

- $46.67 (Daily Sell 2) → extended distribution zone

- Risk management: A close below $44.28 would neutralize the immediate bullish outlook.

30-Day Cycle Outlook

The 30-day cycle high projects into October 17, 2025, where we anticipate the short-term bullish wave could reach exhaustion. If the market sustains above $46 into that window, the probability rises for a push into 47.50–48.00, aligning with Fibonacci and Square of 9 harmonics.

Corrections into that cycle window should be viewed as consolidations, provided price remains above $43.50–$44.00.

360-Day Major Cycle

The 360-day low, confirmed on September 28, 2024, has acted as the long-term anchor. From that pivot, Silver has been climbing a new yearly cycle, with upside trajectories pointing toward $49.97 (360-day Sell 1) and $54.55 (360-day Sell 2) over the next 6–12 months.

This long-term pivot suggests that current price action is only the beginning of a broader structural rally. As long as the market maintains above $40.66 (Weekly Buy 2), the yearly trend remains decisively bullish.

Square of 9 Harmonics

- The $45.72–46.67 zone aligns with a 180° harmonic rotation from the $41.93 low, confirming natural resistance.

- Breaking above $46.70 opens the door toward the $49.97 harmonic (360-day Sell 1), a level of both Gann and VC PMI confluence.

- Downside harmonic support rests at $43.50 (90° rotation) and $41.80 (weekly pivot), both critical retracement markers.

Conclusion

Silver is in the midst of a bullish breakout that confirms accumulation patterns and aligns with both short-term (30-day) and long-term (360-day) cycles. The immediate trading map points toward $46.67 as the next distribution zone, with a break above this level signaling a path to $49.97 in the coming weeks.

Traders should manage risk by using $44.89 (daily mean) as the pivot stop for bullish positions. The probability distribution heavily favors the upside until the October 17, 30-day cycle high comes into play.

Summary Bias: Bullish continuation, targeting $46.67 short-term and $49.97 medium-term, with strong support at $44.28–$42.62.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.