- Alphabet will announce its quarterly results today after the markets close.

- The technology giant seems to be at a crucial juncture in its ongoing growth within the AI revolution.

- Fundamentals suggest the company has the potential to recover its Q1 losses and regain momentum.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

Alphabet (NASDAQ:), a member of the “Magnificent-7” American tech giants, consistently draws investor attention, particularly ahead of its quarterly results. The company’s stock has been on the defensive since the start of the year, dropping more than 17%. However, strong fundamentals and a rising artificial intelligence segment suggest that if the company delivers positive results that surpass market expectations, buyers could end the correction and drive growth.

A few key risks include the uncertainty surrounding the potential escalation of the tariff war, which could lead to a US recession and a drop in advertising revenue. Despite these challenges, Alphabet’s geographic diversification and the nature of its core business make it more resilient to tariff hikes compared to its competitors.

Alphabet’s AI Expansion Amid Monopoly Concerns

Alphabet’s extensive experience, capital, and technological foundation, coupled with its vast user base, position it well to become a global leader in AI development. The company remains committed to expanding its AI footprint, evident in its plan to invest at least $75 billion in expanding data centers and servers to support future growth.

Key AI initiatives include Google Cloud, the generative chatbot Gemini, and the rapidly expanding Waymo division, focused on autonomous vehicle testing and implementation.

Despite this progress, investors may be wary of the ongoing antitrust investigation into Google’s market dominance, particularly as the AI race intensifies. Recently, there were discussions about selling the Chrome browser to OpenAI, but Alphabet has not confirmed this move through official channels.

A crucial consideration for investors is the potential impact of rising tariffs on Alphabet’s financial health. However, the company’s geographic diversification offers strong resilience, with more than half of its business outside the US. Products like Android and the global YouTube platform provide solid foundations for monetizing advertising and subscription revenue across a broad international base.

Strong Fundamentals Favor Alphabet Buyers

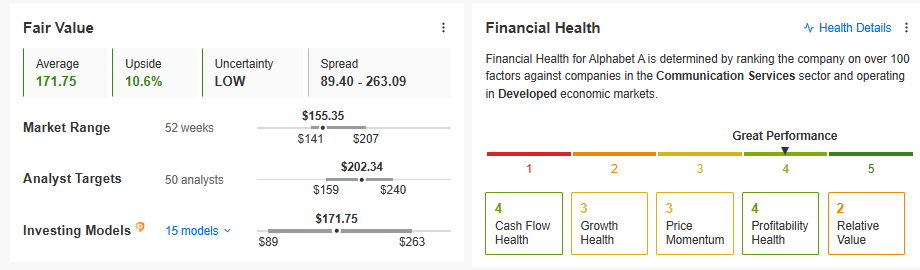

Analyzing both the technical and fundamental landscape just before the release, there are clear advantages for the bulls. The fundamental indicators, including fair value and financial health, suggest a potential rebound, especially if today’s results manage to positively surprise the market.

Technically, the stock is holding strong at the $141-$143 per share support area, where a local consolidation is currently forming. A break above the $170 per share resistance would signal a return to the uptrend, opening the path for a potential test of $185 per share.

If the price falls below $140, the downtrend is likely to resume, with the potential for a decline of up to $20 per share.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.