As of the latest data available, the top three holdings in the iShares Biotechnology ETF (NASDAQ:) are:

- Gilead Sciences (NASDAQ:)

- Amgen (NASDAQ:)

- Vertex Pharmaceuticals (NASDAQ:)

These three companies collectively represent approximately 25.68% of the ETF’s total assets.

With GILD in top technical position, AMGN and VRTX are also looking interesting.

As part of our Economic Modern Family, Biotech the ETF, is an interesting member.

Part cyclical and part non-cyclical, IBB has been a political football for years. Big pharma also represents a significant lobbying influence.

I also figure you watch a chart long enough, it starts to speak louder and louder.

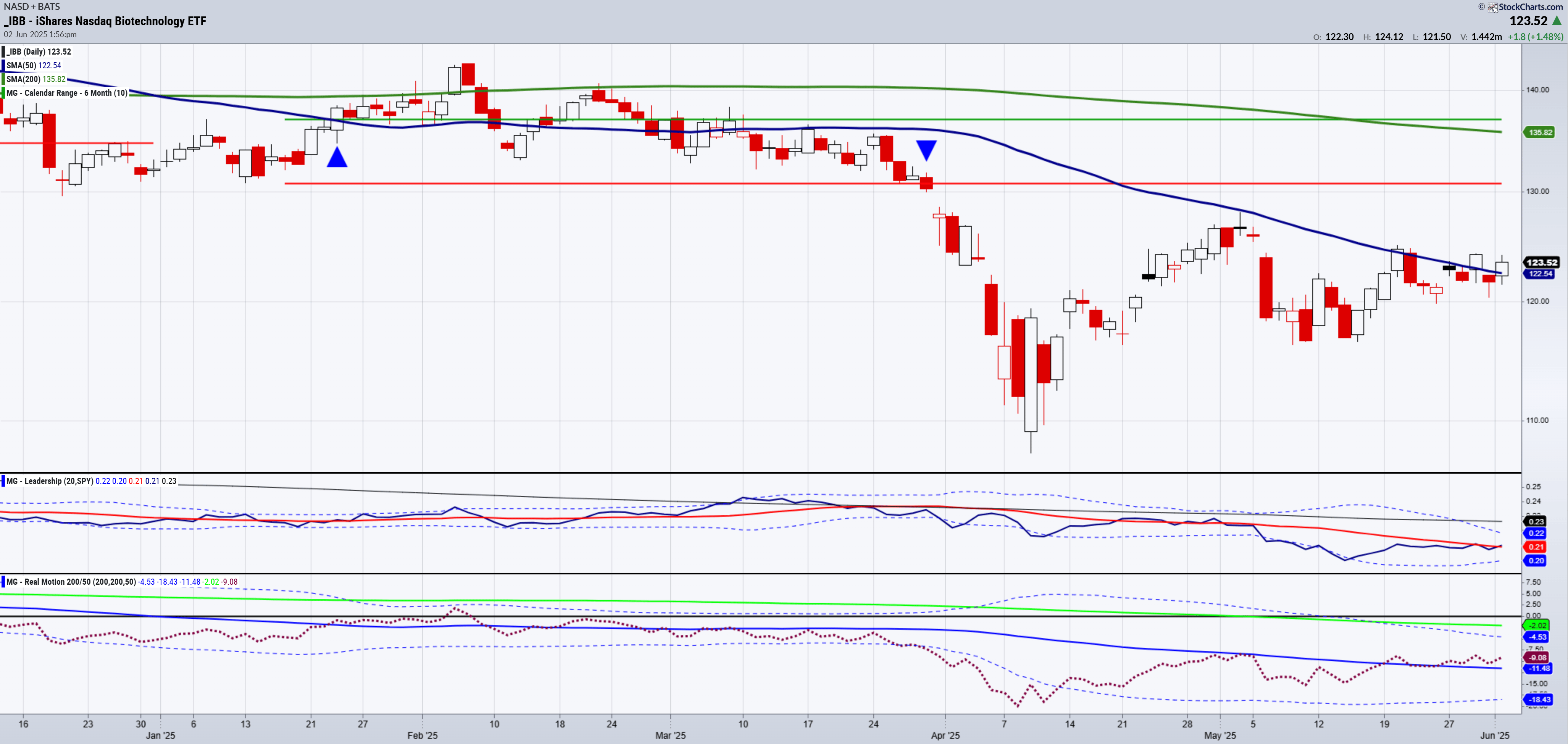

The daily chart shows that today, IBB is clearing the 50-DMA. The slope on the moving average is down.

That is a pretty good reason why the last 4 times IBB tried to clear the 50-DMA, it failed to hold above it.

Weak recuperation phase.

So, the first thing is we need to see a second consecutive close above the 50-DMA.

Real Motion shows a better scenario over its 50-DMA, as the momentum is improving.

IBB performs on par with .

On the weekly timeframe,

I like where IBB found support during the flush in 2023.

Similarly, the flush this past April 2025, IBB found support around the same levels or approximately $115.

Now, it is possible a double bottom on the weekly chart is forming.

The stronger signal on that double bottom will be a weekly close above 123.50.

But, since it is only Monday, we go back to the Daily chart and will first watch for the confirmed phase change.

IBB has been underperforming the market for the last 3 years.

This is the classic contrarian trade potential, only advised if you use chart analysis and risk management.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

S&P 500 (SPY) 575 support to hold 600 to clear

Russell 2000 (IWM) 200 support to hold 210 to clear

Dow (DIA) 400 support 425 resistance

Nasdaq (QQQ) 528 resistance

Regional banks (KRE) 55 support to hold

Semiconductors (SMH) 250 to get through

Transportation (IYT) 68 resistance

Biotechnology (IBB) Watch for the 50-DMA to clear and confirm over 123

Retail (XRT) 75 support and 77 resistance

Bitcoin () 102k closest support