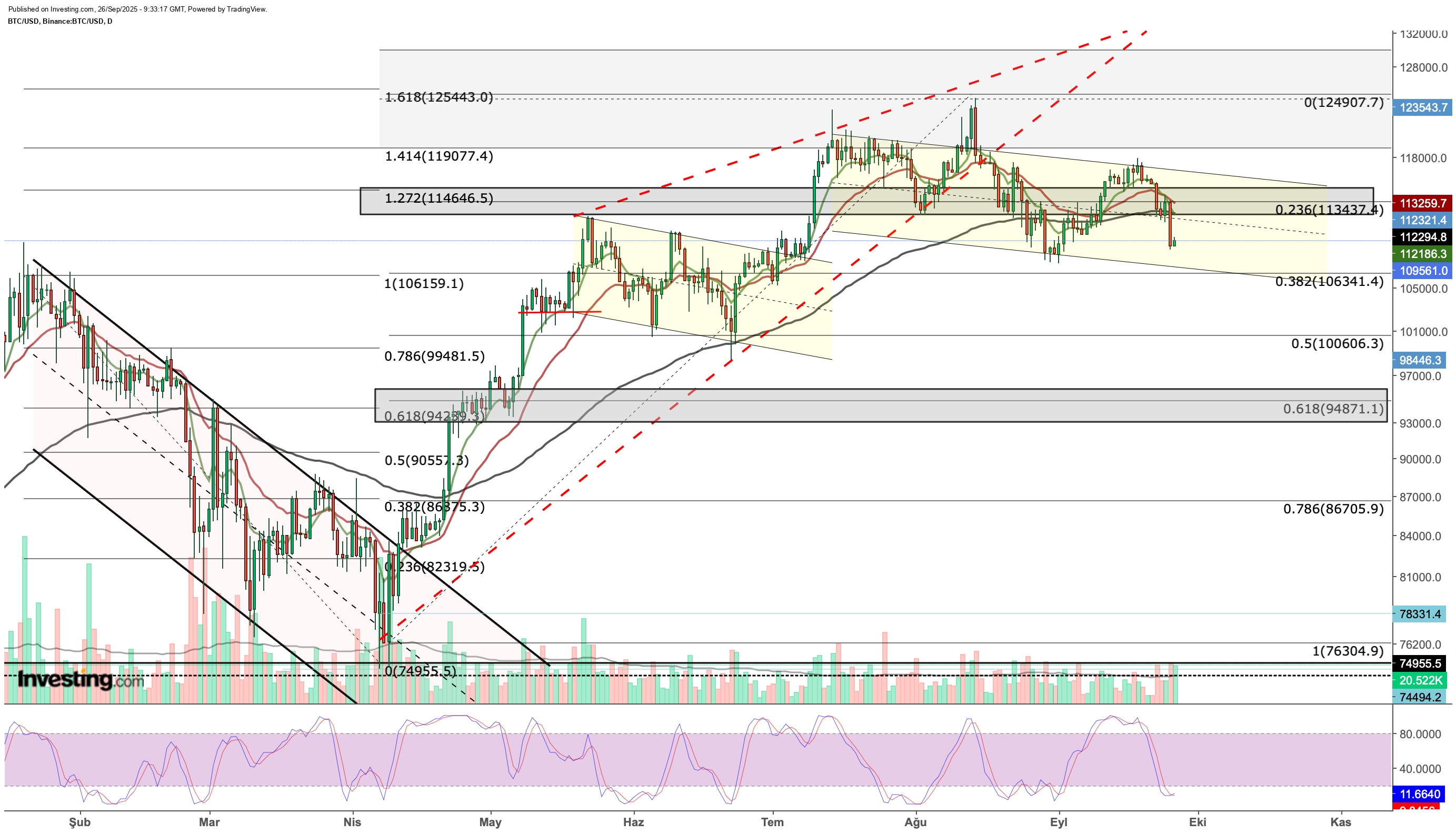

Bitcoin struggles below $114,600, with weak buying around $109,000 signaling bearish momentum.

Critical support at $106,000 will dictate whether Bitcoin reverses or extends its downtrend.

US PCE data today may drive volatility, influencing Fed policy and Bitcoin’s risk appetite.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

, we highlighted $117,000 as resistance and $114,600 as support for . The price failed to stay above $117,000 and quickly dropped below $114,600, triggering stronger selling.

Buyers tried to step in around the $111,000 support, but demand was weak, and the price slid further to about $109,000 yesterday. This confirmed that Bitcoin could not hold the $114,600 level, and the bullish setup did not materialize.

Now, the cryptocurrency has fallen back into its downward channel and is moving toward the lower band. The bearish momentum has also pushed the daily Stochastic RSI into oversold territory. Traders will be watching the support zones closely to see where a rebound might occur.

Right now, Bitcoin is seeing some buying interest around the $109,000 support level, which it last tested at the end of August. But so far, the demand has been weak. If the price slips below this support, it could fall toward the $107,000–$107,200 range. A sharp increase in selling volume could even push it quickly down to around $106,300.

Bitcoin Faces Pressure Near Lower Boundary of Falling Channel

Looking at the bigger picture, Bitcoin started losing momentum in the second half of August. If it breaks below the $106,300 support in the coming days, the decline could extend toward $94,800. In that case, the $100,000 level may serve as a psychological support zone.

A daily close under $106,300 would also pull short-term EMA values lower, which would act as another technical signal pointing to further downside.

For Bitcoin to reverse its negative trend, holding above $106,000 is critical. If buying interest strengthens in this zone, the next key level is $112,000, which has now turned into resistance. A move beyond that could open the way toward $115,000 and test the upper band of the falling channel. A weekly close above this channel would be a strong technical signal for a new upward trend.

Right now, Bitcoin remains inside the falling channel. If selling pressure down to the $106,000 level eases, the path for an upward move could open. Traders will be watching how the price reacts near the upper band of the channel. On the other hand, a break below $106,000 could trigger a deeper decline.

Bitcoin Awaits US PCE Data for Direction

Macroeconomic factors are also influencing Bitcoin’s direction. The , due today, is expected to add volatility. This inflation gauge, closely tracked by the Fed, plays a key role in shaping .

Market expectations point to an annual reading of 2.9% and a monthly rise of 0.2%. With Powell’s recent cautious remarks and similar tones from other Fed members, risk appetite is already weak. If the data comes in higher than expected, hopes for rate cuts could fade further, pushing investors away from risky assets like Bitcoin and driving prices lower.

On the other hand, if the data comes in as expected or lower, it could ease pressure on markets. Falling inflation would allow the Fed to focus more on employment and create room for interest rate cuts, which could boost demand for riskier assets.

Recent US data showed the economy remains resilient, supporting a recovery in the . Strong ongoing growth could also add upward pressure on inflation. This makes today’s PCE release especially important for the direction of risk assets like Bitcoin.

****

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

- AI-managed stock market strategies re-evaluated monthly.

- 10 years of historical financial data for thousands of global stocks.

- A database of investor, billionaire, and hedge fund positions.

- And many other tools that help tens of thousands of investors outperform the market every day!

Not a Pro member yet? Check out our plans here.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.