The monthly jobs report hit today (unusually, on a Thursday, due to the real and perfectly sensible holiday tomorrow blocking the typical Friday release) and the reaction was immediate. All the equity futures remain strong, but paradoxically, it can sometimes be a spike to the upside that breaks the back of a long climb.

We’ll see if that holds true, but for the moment, the had a sudden, violent jump upward and is now hanging out at a positive .4%.

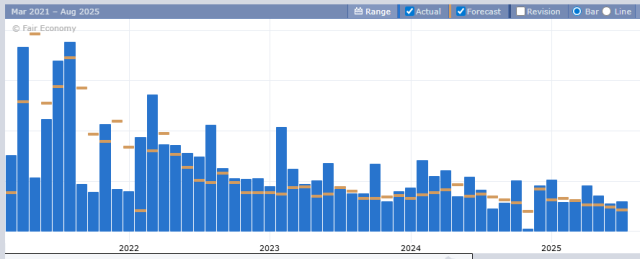

The strong jobs number was definitely a surprise to the predictors out there, although we shouldn’t get carried away that the U.S. is printing jobs like they’re going out of style. The trend, for years, has been fewer and fewer new jobs created. It certainly seems whatever nail trimmers were used in the DOGE effort weren’t a big deal.

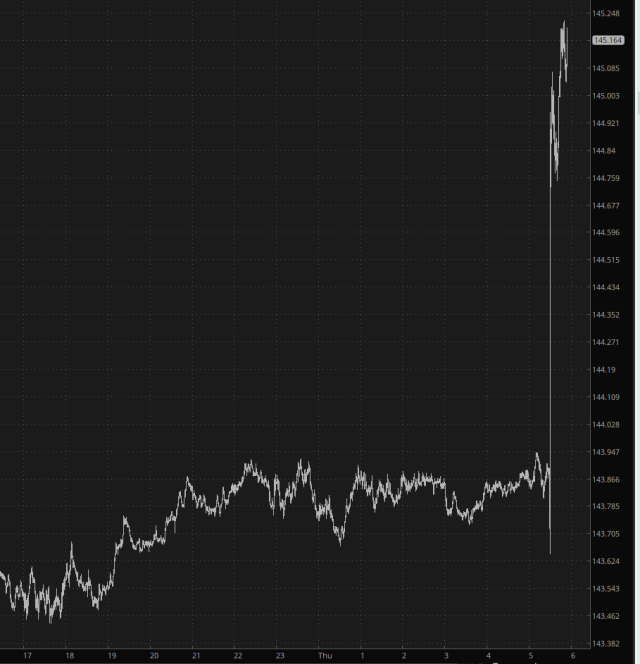

The relatively firm report, however, chilled the idea that Powell has to rush out there and slash rates. Thus, the is ripping higher versus the .

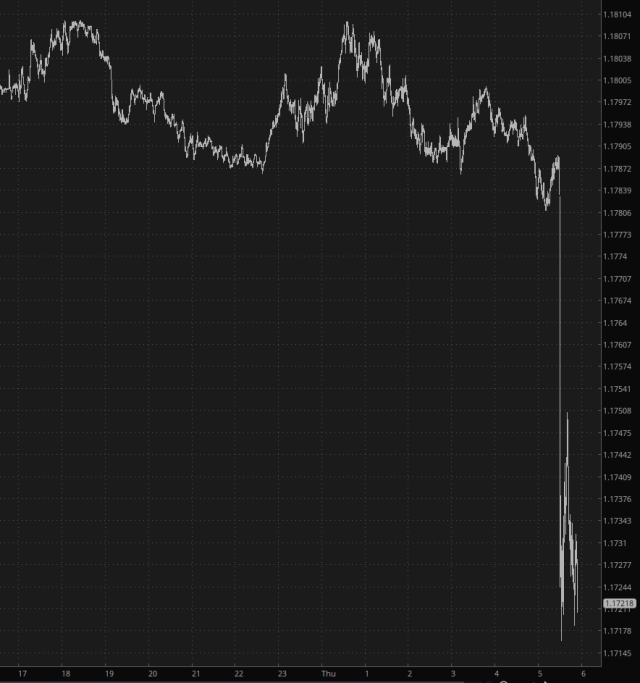

And the is plunging relative to our dollar.

And, understandably, bonds (which I am short by way of ) are tumbling.

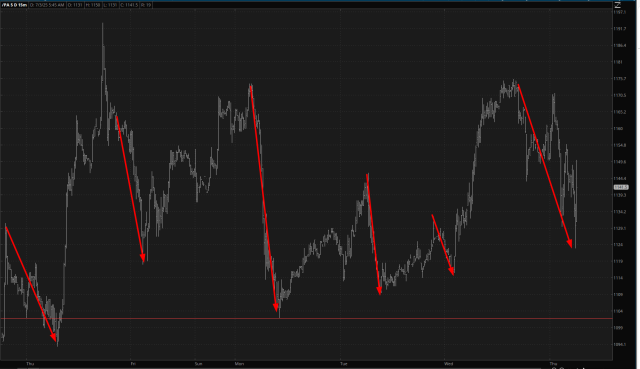

With the dollar doing so well, precious metals are having a lousy morning. I must say, as a person who is rather new to the world of , I’ve noticed a curious effect in this very thin market: it tends to sell off between sessions.

This is annoying, of course, because night after night I get to watch /PA get bitch-slapped lower and yet, once the cash markets open up, it is allowed to heal. At least support has held and, short-term, we’ve hammered out some lower highs. Still, my paper hands aren’t really made for this kind of thing.

It felt odd to care so little about the report this morning, but my positioning is so danged light that I was experiencing a Don’t Really Care feeling (so it’s a good thing the markets aren’t crashing!) Now that the jobs data is behind us, I’ll probably feel more comfortable re-entering some carefully selected shorts and getting out of my feeble positioning.