With gold leading “inflation expectations” and silver leading gold, it’s the best of both worlds, but may not be sustainable, long-term

First some definitions, per my usual work:

- is less economically cyclical and less inflation sensitive than silver

- Contrary to popular believe, gold miners do not benefit from cyclical inflation

- A rising Silver/Gold ratio indicates future potential for a resumption of an inflationary macro

- A rising Gold/RINF ratio indicates either the inflation will not work as well for cyclical markets as it has in the past (Stagflation), or that the Silver/Gold ratio will have a shelf life.

As of today, the Silver/Gold ratio is still bulling along with its analytical running mate that we use in NFTRH since April to consider and then project the current rallies, the TSX-V/TSX ratio. These indications remain tailwinds for gold/silver miners and several other commodity areas.

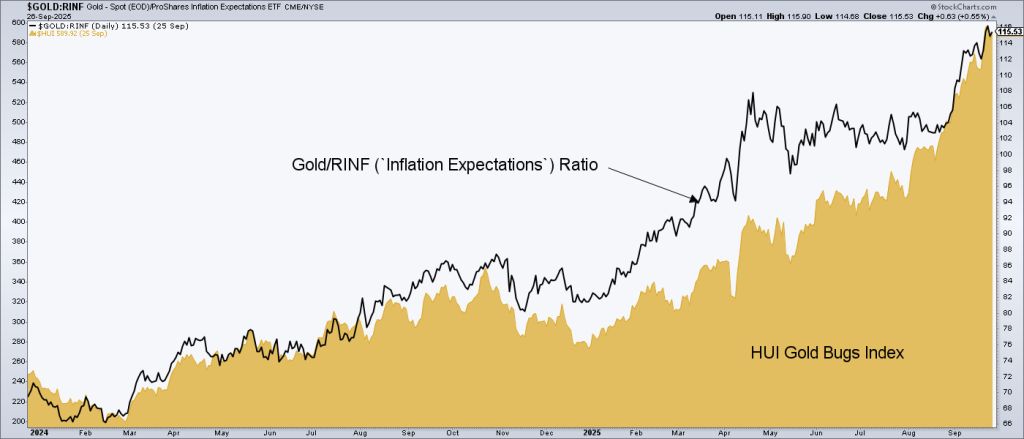

However, throughout the rally in gold stocks, we have used this chart to make sure the miners were still rising in line with a positive, disinflationary, market signal. Well folks, you can’t get much more in line than is with its fundamental guide than it is currently.

Let’s bring Gold/RINF and Silver/Gold together with a view of two positive messages for the HUI Gold Bugs index. The gold price continues to outpace the market’s inflation signals. A positive from a macro-fundamental standpoint.

Yet the Silver/Gold ratio (showing Thursday’s close) is also rising. A positive from a sector internal standpoint (silver often leads the bull phases in the precious metals).

Hence, HUI is following two positive, but very different internal indications.

But There’s More…

Not discussed above, but still very positive are two other internal indicators, the HUI/Gold ratio and the HUI/SPX ratio. Combined with Gold/RINF, Silver/Gold and TSX-V/TSX, that is 5 internal tailwinds for gold and silver miners (along with other commodity/resource producers/prospects) currently in play.

Bottom Line

The macro is fully intact to the bullish backdrop for gold and silver stocks.

That could all end tomorrow.

But it has not ended on any given “tomorrow” to this point.

The sector is bullish and its internals are stellar.

As some point in the future, the Gold/RINF ratio and Silver/Gold ratio should decouple because they have fundamentally different implications for the macro situation. Then we’ll have a more complicated environment. But for now, it’s all systems go from the perspective of the internals.