On Monday, a gap-down opening by the for December looks evident enough to keep this slide steeper if the gold futures make a sustainable move below the immediate support at the 20 DMA at $3407 as the investors are waiting for crucial US readings and some clearance from Washington over tariff rulings on bullion bars as these rulings have triggered dislocation in bullion flows, prompting refiners to halt shipments to the U.S.

Moreover, the US-China tariff truce, which has kept escalating duties in check, is due to expire on August 12, while investors are hopeful of its extension, resulting in a surge over the outcome.

Undoubtedly, if this tariff truce is resolved according to the conditions acceptable to both the U.S. and China, gold futures could see more downside this week, as a success on this front will trigger a selling spree in gold futures.

I find that investors are mainly focused on key U.S. inflation measures as the July Consumer Price Index is due Tuesday and is expected to show around a 0.2% increasing from June, and this will be followed by the latter this week as these reading will provide some clues for assessing the , with rate cut expectations priced near 89% for September while weak labor data, released earlier in August also strengthen rate cut bets too.

Undoubtedly, everything seems dependent on hopes as Washington’s stance on tariff rulings on bullion bars, success over resolving US-China truce, and the upcoming economic data could raise volatility in gold futures due to the thick presence of both the bulls and bears at the current levels. Still, the upside seems to be capped at $3510 while the downside could be deeper if the gold futures find a breakdown below the significant support at $3372 this week.

Technical Levels to Watch

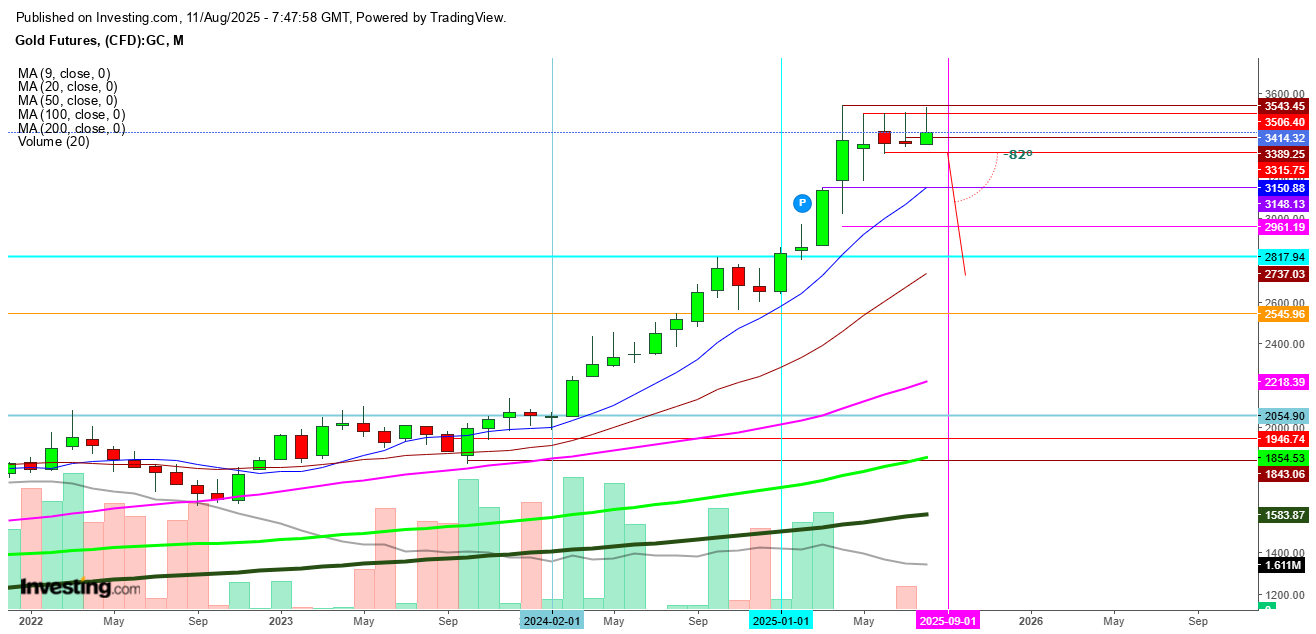

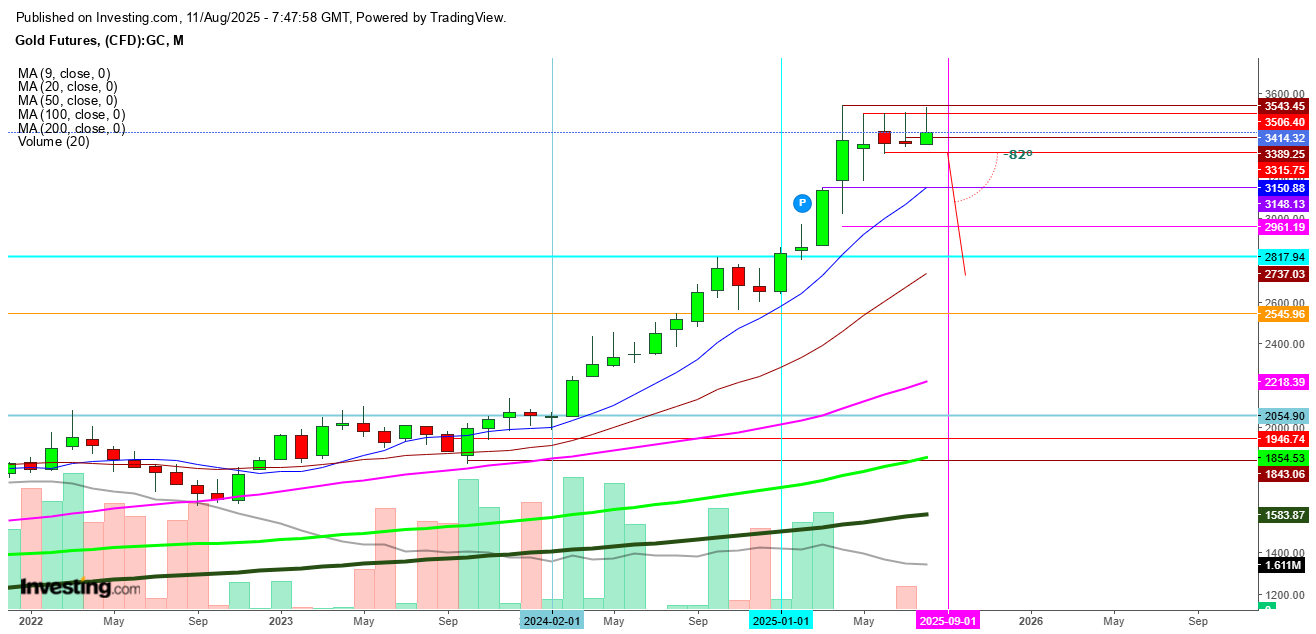

In a monthly chart, gold futures are facing stiff resistance at $3510 as despite attempting a breakout above this last Friday, resulted in advent of selling spree while the futures are constantly struggling to find a sustainable move above this since they tested a high at $3543 in April, 2025 while the downside seems to open if the futures find a breakdown below the significant support at $3315, tested in June, 2025.

In a weekly chart, gold futures are in the bearish zone as they are maintain a slide this week after facing stiff resistance at $3465, despite some eruptive moves seen during the last two weeks when the gold futures tested a high at $3534, after testing a low at $3322 in the previous week of July, 2025.

Undoubtedly, the currently prevailing indecisiveness could keep the gold futures volatile, but the exhaustion will remain as the bears will continue to load fresh shorts whenever the gold futures try to move above $3500 levels.

In a daily chart, after testing a fresh high at $3536 on Friday, gold futures followed a sharp selloff, resulted in an the formation of an indecisive candle where the opening and closing levels were nearly same despite testing a high at $3536 and a low at $3445, and the Monday’s move look evident enough to indicate a thick presence on big bears as the gold futures have already found a breakdown below the significant support at $3444, and heading toward the next support at the 20 DMA at $3406 where a breakdown could push the futures towards the next support at the 50 DMA at $3378.

Undoubtedly, if the gold futures are not able to defend this significant support at the 50 DMA in the daily chart, they could head to test the next support at the 100 DMA at $3312, where a breakdown will confirm this slide to turn steeper to hit my first target at $3210 before Aug. 28, 2025.

Disclaimer: Readers are advised to take any position in gold futures at their own risk, as this analysis is based only on observations.