have started the week on the back foot as hopes grow over a barrage of trade deal announcements are expected this week.

The initial July 9 deadline by the Trump administration approaches but there has been mixed messaging which may limit Gold’s downside potential ahead of the announcements

Federal Reserve Minutes and US Dollar Index

The has seen a bit of an improvement with USD demand rising slightly on tariff hopes. Positive developments on the trade deal front may help the US Dollar regain some of its shine and thus weigh on prices.

Stronger last week has also kept the US Dollar supported with markets continuing to price in a 95% probability of no rate cut at this month’s . Markets are still eyeing cuts this year as President Trump also ramped up his rhetoric with regard to the Fed and the lack of movement on rates.

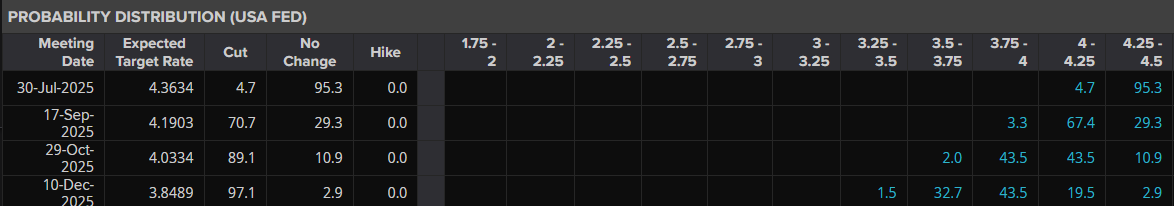

For now though, markets are pricing in around a 67.4 percent chance of a 25bps in September. The data comes courtesy of the LSEG workspace central bank watch is still pricing in two rate cuts this year. Source: LSEG Workspace

Source: LSEG Workspace

Middle East Tensions Rear their Head

The precious metal may find some support following renewed strikes over the weekend by the Israeli military on Yemen and Lebanon. Any indication of an uptick of geopolitical risk and markets may once again flock toward safe havens.

Trade Deal Announcements to Drive Markets this Week

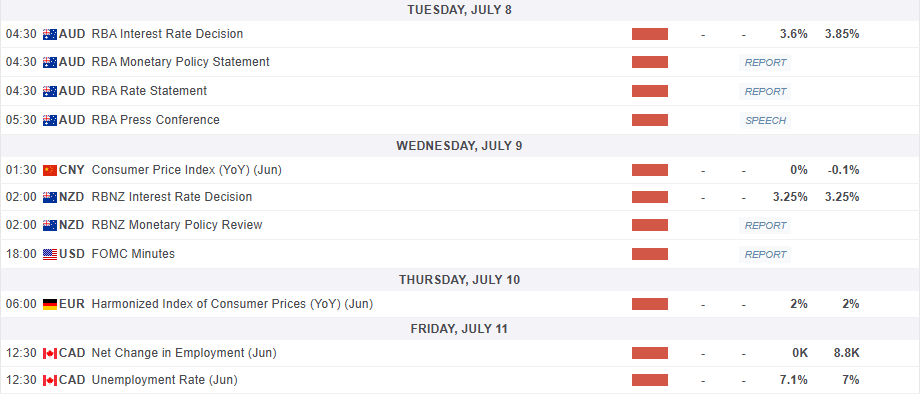

Looking ahead to the rest of the week, the economic calendar is rather quiet with the exception of the FOMC minutes release on Wednesday evening.

Trade deal announcements will likely be the key focus which will drive overall market sentiment and risk appetite. A short while ago we heard from US Treasury Secretary Scott Bessent who told CNBC that “We are going to have several trade announcements in the next 48 hours”. A bold statement and one which markets hope will finally come to fruition and arrest the uncertainty that has dragged on since the start of the year.

Such a move could weigh on Gold prices especially if markets perceive the announcements as being positive. Alternatively, if the deals do not please market participants this could result in a bounce for Gold prices.

Either way trade deals will be the main driving force for volatility and market moves this week.

Source: MarketPulse Economic Calendar

Technical Analysis – Gold (XAU/USD)

From a technical standpoint, Gold is on the back foot at present with the technical picture also showing signs of the uncertainty.

Since bottoming out on June 30, Gold has broken structure on the four-hour chart hinting that bulls may have resumed control.

This was then followed up by lower highs and lower lows, which could be a sign of the uncertainty in markets at present.

Looking at the four-hour (H4) chart below, i have drawn on a fibonacci retracement with the precious metal bouncing today just shy of the golden pocket area of 61.8%.

This begs the question, are we in line for another leg higher?

Given that trade deal announcements are on the horizon it will be interesting to see how this develops over the coming days.

Gold (XAU/USD) Daily Chart, July 7, 2025

Source: TradingView

Source: TradingView

Support

Resistance