surged yesterday ending the day with a 3.75% gain as + surprised markets with a supply increase that came in below expectations. Add to this rising tensions between Russia and Ukraine over the weekend and the perfect cocktail for gains materialized.

Ukraine launched major drone attacks on several Russian airfields just before peace talks between the two countries this week. Meanwhile, some US senators are pushing for stricter sanctions on Russia, including a proposal for 500% tariffs on imports from nations that purchase Russian oil.

This could in part explain yesterday’s rally.

OPEC+ Meeting, Russia-Saudi Arabia Tension

Saudi Arabia and Russia had a tough time agreeing on OPEC+ oil policies on Saturday. Saudi Arabia wanted to speed up oil production increases, while Russia preferred to hold off, according to sources familiar with the talks.

Tensions are growing between these two major OPEC+ members after years of smooth teamwork. The last big disagreement was in 2020, when both countries pumped as much oil as they wanted, causing prices to crash.

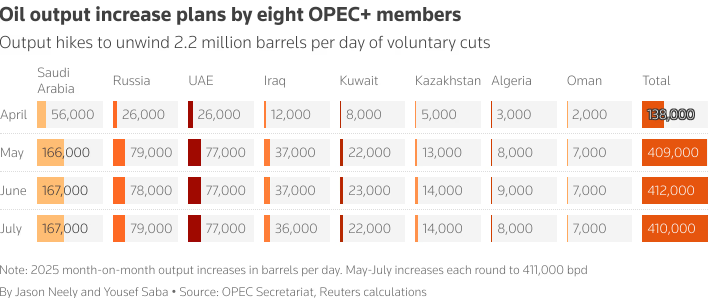

On Saturday, eight key OPEC+ members decided to increase oil production by 411,000 barrels per day starting in July, following similar increases in May and June. This is part of a plan to gradually reverse production cuts made over the past five years to stabilize the market.

Source: LSEG

Oil prices are trading at levels last seen in March 2021 when the post-covid recovery was underway. The price of Oil is posing challenges for Oil producers with US producers in particular feeling the heat. The Trump administration had eyed a massive oil drive during its campaign but recent rig counts show that with prices at current levels this does not seem plausible.

According to the latest Baker Hughes report, the number of active oil rigs in the US dropped by 4 to 461, marking the fifth week in a row of declines. Given that markets are concerned about a slowdown in global growth, a surge in US drilling activity in the next 12 months seems like a pipe dream at this point.

OECD Lowers Global Growth Forecast

The Organisation for Economic Cooperation and Development (OECD) has added to the fears of market participants by downgrading its global growth forecast for 2025 and 2026 from 3.3% to 2.9%.

However, judging by today’s price action, market participants have for now shrugged this off as Oil prices have turned green for the day just as the US session begins.

What is Supporting Oil Prices?

Looking at all that we discussed above, one would think should be under pressure. Sure, the OPEC+ production numbers may be a let down and partially supported prices, but with a worsening global outlook and PMI data from both China and the US one would assume Oil prices may be under pressure.

On Monday an Iranian Diplomat stated that Iran was poised to reject a US proposal to end the nuclear dispute which has kept severe sanctions in place on Iranian Oil exports and the country as a whole. This has raised the risk premium on Oil prices as markets had been pricing in a potential deal between the two countries which could have led to an increase in Iranian supply.

Another factor that could be aiding Oil prices of late could be the weaker US Dollar which has faced consistent selling pressure as concerns mount about the US deficit and slowdown in growth.

However, right now it is almost impossible to pinpoint one exact reason for the rally in Oil prices or whether it will continue.

Technical Analysis – Brent Crude

From a technical analysis standpoint, Brent remains in a range between the 66.90 resistance handle and support around the 62.80 handle.

Looking at price action, it remains rather mixed with the most recent lower low being followed up with a higher high, which means another change in structure has taken place.

Bulls appear to have the upper hand for now- with a daily candle close below the support handle at 62.80 needed for further downside to materialize.

On the downside support rests at 61.08 and the 60.00 psychological handle.

A move higher would require a close above the 66.90 handle before a move toward the 68.19 resistance handle may come into focus.

Brent Crude Oil Daily Chart, June 3, 2025