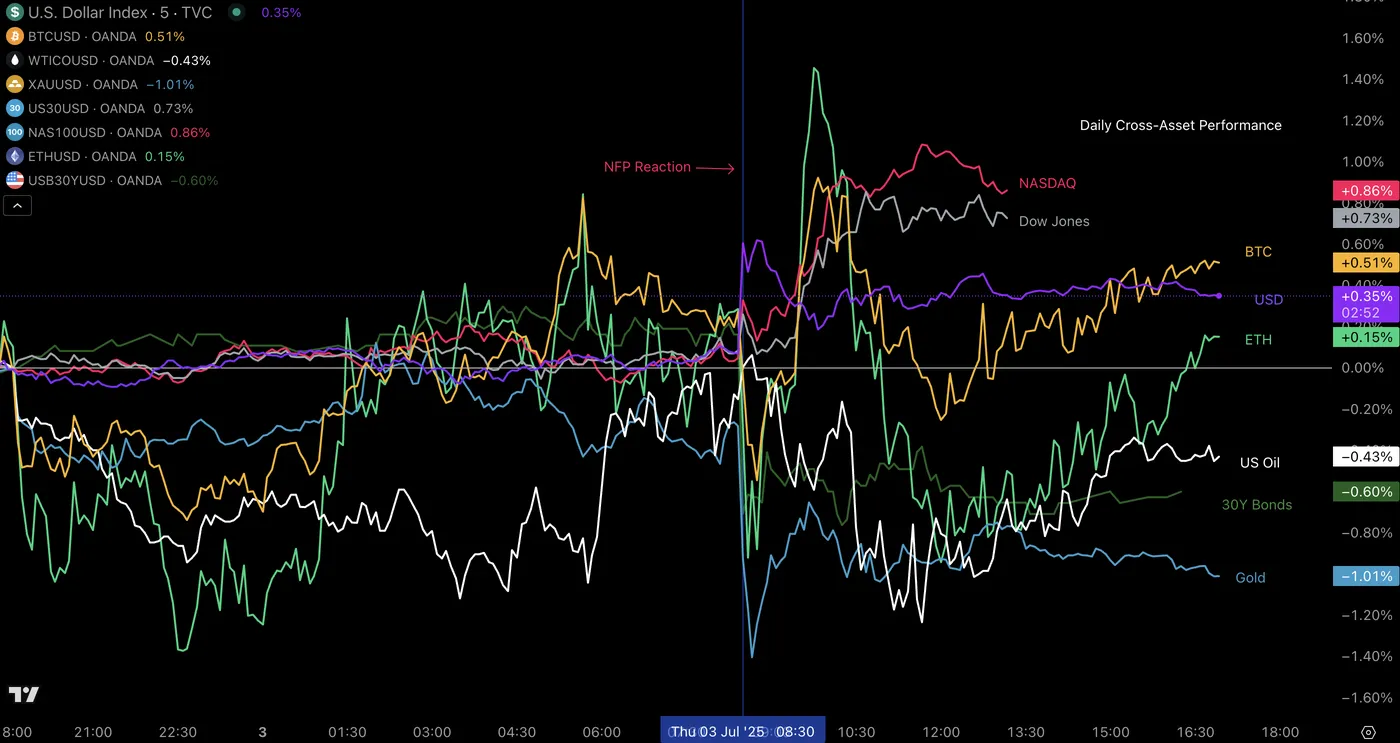

Yesterday’s market action was driven by consecutive upside surprises in US (147K vs 110K exp) and data (50.8 vs 50.5 exp), fueling another wave of positive sentiment and pushing US equities into yet another frenzied rally.

The reaction to the data was progressive but consistent, taking Safe-Havens like and US Treasuries down, also dragging down the safer and .

In contrast, the risk-on session pushed upward risk assets, like Consumption Commodities – known in Finance as Softs, with Orange Juice and rallying above 6% and Cryptos additionally enjoying from the news.

The reaction in energy commodities was, however, mixed, with the assets rising initially before giving back their gains and closing down small.

Daily Cross-Asset Performance

Source: TradingView

The market’s initial reaction to the number was somewhat tricky, as flows quickly changed between the 8:30 release and the US Equity open at 9:30 A.M.

Watch the reaction for cryptocurrencies for example, with once again subject to high volatility in the session.

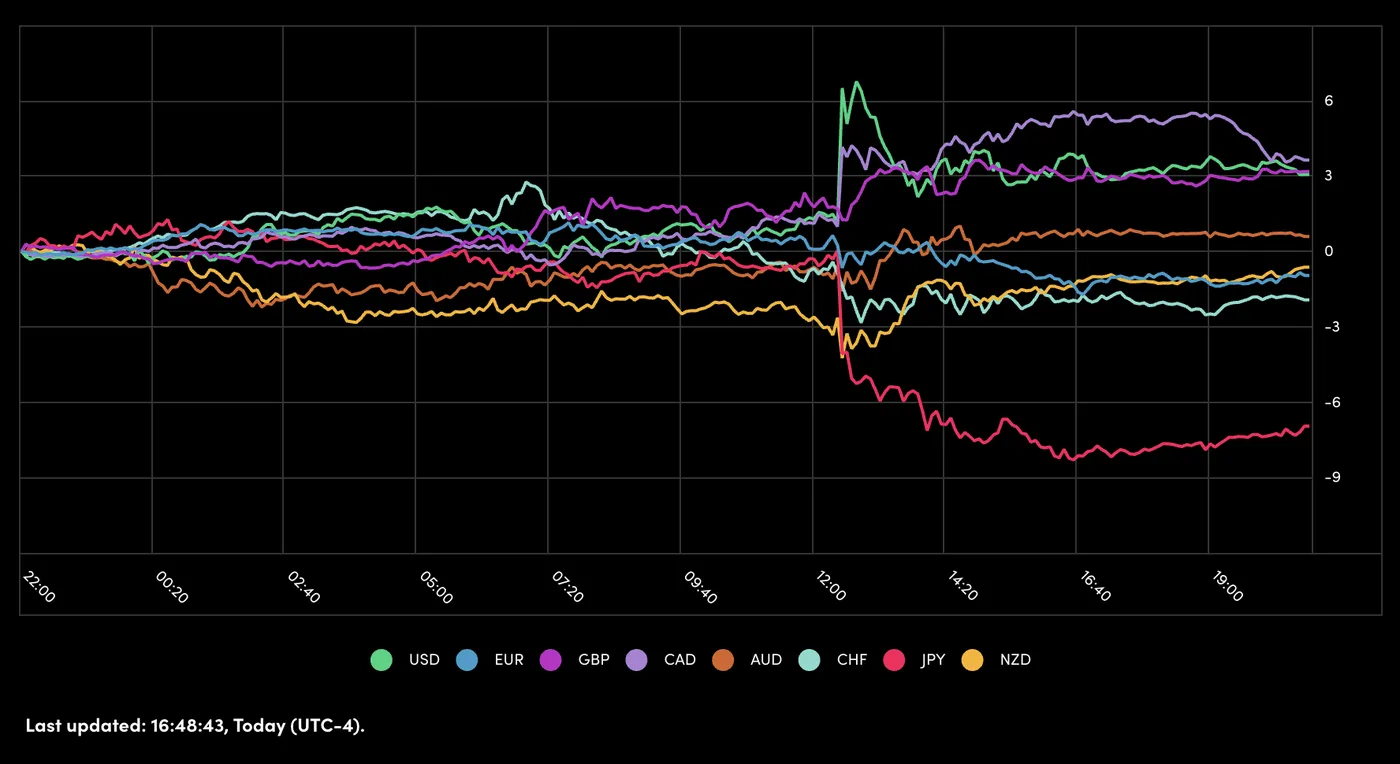

A Picture of Performance for Major Currencies

Source: OANDA Labs

The was somehow the strongest of majors, with Gilts majorly recovering from yesterday’s volatility, seeing GBP/USD up small against the Dollar.

On the other hand, the led all majors (with the unchanged) and particularly against its lower-yielding safe-haven currencies in the CHF (-0.50% vs USD) and the Yen (-0.88%).

Monday’s reactions in the Dollar Index will be key to monitor (a formal invitation to consult our most recent Analysis).

Today’s session should be more than calm, with US Traders off, volumes and movement tend to be relatively subdued.

However, traders should still prepare for an active Monday as some of the flows may trickle to next week as Thursday’s session got cut short with the Early US Close.

The only economic calendar events today is the and European Data, which might move the a bit.