are displaying one of the most intense episodes of volatility in recent memory, with the market producing nearly a $3 intraday reversal this week before stabilizing back toward the $47.50–$48.00 pivot zone. The magnitude of these moves confirms that silver has entered a new volatility regime, with accelerated price discovery around the higher Fibonacci and VC PMI levels.

Current Technical Position

As of this writing, silver is trading at $47.60–$47.70, up 2.64% on the session. The daily VC PMI pivot rests at $46.70, while the weekly pivot is at $45.66. The fact that the market recovered quickly from the deep low of $44.89 and closed above both daily and weekly pivots suggests strong demand entering near those levels.

Resistance now lies at the Daily Sell 1 (47.68), Weekly Sell 1 (47.95), and Daily Sell 2 (48.99) levels. A decisive close above $49.24 (Weekly Sell 2) would project acceleration toward the $50.50–$52.00 zone, aligning with Square-of-Nine harmonics.

On the downside, failure to hold above $46.72 would re-open tests of Daily Buy 1 (45.38) and Weekly Buy 1 (44.37). Below this band, Weekly Buy 2 (42.08) and the Square-of-Nine extension at 41.57 define deeper reversion zones.

Cycle Analysis

- 30-Day Cycle: The most recent low was confirmed at $44.89, setting a 30-day anchor. From here, the cycle projects a short-term peak window into mid-October, with resistance likely between $49.50–$50.00.

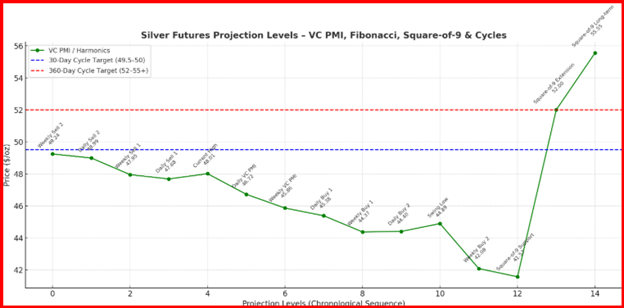

The updated Silver Futures projection chart with the 30-day and 360-day cycle targets added:

- Blue dashed line (49.5–50.0): Short-term 30-day cycle peak projection into mid-October.

- Red dashed line (52–55+): Long-term 360-day cycle target into late summer 2025.

- Green line: VC PMI pivots, Fibonacci levels, and Square-of-9 harmonics.

This way, you can visually track how the short-term reversion levels align with the longer-term bullish cycle targets.

- 360-Day Cycle: The September 28, 2024, low at $21.93 (spot equivalent) continues to serve as the dominant long-term cycle anchor. Based on this alignment, the market remains in the rising phase of a 360-day advance, projecting a cycle top window into late August 2025. The interim secondary high into October aligns with Gann’s 180-day harmonic, reinforcing current upside pressure.

Square-of-Nine Harmonics

Using the Square-of-Nine, $47.68 (Daily Sell 1) and $49.24 (Weekly Sell 2) align with the 360° rotation from the September 2024 anchor. A confirmed breakout above $49.24 unlocks $52.00, followed by $55.55, which harmonizes with the 720° extension.

Outlook

Silver’s near-term trajectory depends on whether it can sustain closes above the $47.95–$49.24 resistance band. If achieved, a breakout toward $50–$52 is probable. Failure here risks renewed mean reversion back toward $45–$44. The structural 360-day cycle remains bullish, favoring higher prices into 2025.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.