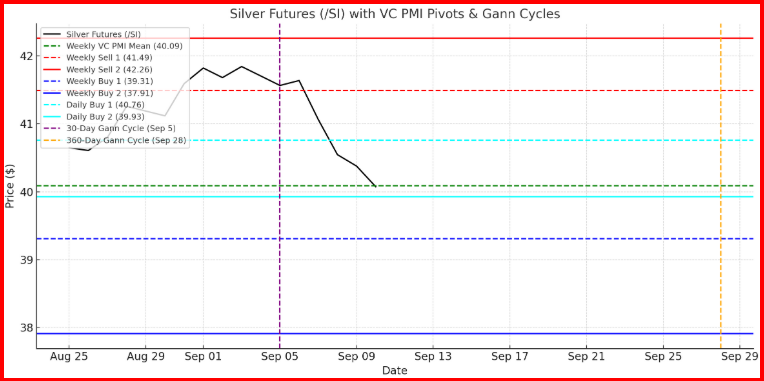

futures are trading at $41.77 as of September 3, 2025, holding just under the recent intraday high of $41.995. The rally from last week’s breakout at $40.00 has carried price into the weekly Sell 1 ($41.49) zone, with upside resistance defined at Sell 2 ($42.26). From a Variable Changing Price Momentum Indicator (VC PMI) perspective, the market remains in a bullish phase, trading above the weekly mean at $40.09, which serves as equilibrium for this week’s activity.

On the daily framework, support aligns at Daily Buy 1 ($40.76) and Daily Buy 2 ($39.93). These levels, in harmony with Fibonacci retracement zones at 38.2% ($40.51) and 61.8% ($39.72), form a confluence demand band between $40.00 and $40.75. The market tested this zone before reversing higher, confirming its role as a foundation of short-term strength.

Gann Cycle Analysis

The 30-day Gann cycle is projecting a pivot window into September 5–6, 2025, aligning with the current price challenge of overhead resistance. The strength into this window suggests a potential cycle crest is forming. If the market consolidates or fails to break $42.26 decisively, probability favors a retracement into the demand zone outlined by the daily pivots.

The broader 360-day master cycle, anchored from last year’s September 2024 low, projects a major time window into late September 2025 (around September 28). Historically, this master cycle has aligned with significant trend inflection points. As Silver now tests multi-year highs above $41.50, this cycle window could mark either a continuation breakout above $43.00 or a long-term corrective phase back toward the high $30s.

Market Momentum

Momentum indicators, particularly the MACD, show flattening signal lines with a neutral histogram. This suggests the rally is losing immediate thrust, though not yet reversing. Volume confirms strong accumulation into the breakout above $40.00, but the reduced follow-through near $42.00 hints at exhaustion.

Trading Implications

- Bullish Scenario: A decisive close above $42.26 would confirm a breakout, targeting $43.00–$43.50, with cycle alignment potentially carrying strength into the September 28 master cycle window.

- Bearish / Mean Reversion Scenario: Failure to sustain above $42.00–$42.26 would set the stage for mean reversion back toward $40.76–$40.00, with deeper support at $39.31 (weekly Buy 1).

Conclusion

Silver futures are in a critical convergence zone. With the 30-day Gann crest approaching September 5–6 and the 360-day master cycle looming at month’s end, traders should prepare for heightened volatility and potential inflection. Probability favors mean reversion near-term, but the larger cycle could deliver a decisive breakout or correction by late September.

***

TRADING DERIVATIVES, FINANCIAL INSTRUMENTS AND PRECIOUS METALS INVOLVES SIGNIFICANT RISK OF LOSS AND IS NOT SUITABLE FOR EVERYONE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.