When retail investors try to gauge the potential future of the stock market or the companies they decide to invest in, there are typically two areas to watch. The first is the business side of the economy as a driver, and then the consumer side as a secondary driver, which comprises the bulk of future growth that boosts or busts the broader index.

Today, there are reasons to believe that both drivers are dragging future GDP growth lower, creating a real tail risk for the S&P 500 and other constituents in the future. That being said, new hints are coming out of the consumer sector of the economy, focused on airline stocks as a historical leading indicator of where spending habits may be headed.

During earnings season, airlines have cited some worries about lower future spending on travel, a typical reaction as consumers become more budget-conscious in the volatility and uncertainty currently present in the financial markets. The latest comments came from the CEO of Southwest Airlines (NYSE:) Co., who admitted that the entire industry is in recession already, but that was more of a strategic comment than a regretful one, it turns out.

Confidence Remains in Southwest Airlines Stock

Even though the admission of recession may seem like a negative event in the short-term, investors need to realize that this might have been a particularly strategic choice to bring the worst of the price action to competitors like American Airlines Group (NASDAQ:) Inc. and Delta Air Lines Inc (NYSE:).

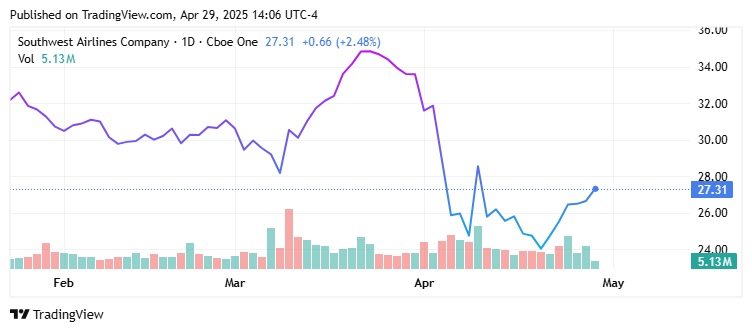

Over the past quarter alone, Southwest has outperformed these other airline carriers by as much as 20% to even 30%, showing retail investors where preferences are centered for the broader market.

The question becomes, why did Southwest manage to outperform its peers despite these negative comments from its CEO?

For one thing, Southwest has demonstrated a greater ability to hedge the changing fuel costs that come with swings in oil prices. The expectation for higher oil prices to come as the dollar weakens, as well as the tailwinds formed by bets on lower interest rates for the rest of the year, could be behind this price action.

More than that, Southwest’s regionally focused routes are typically less cyclical than the international routes and cross-country routes under which these other peers operate. This is perhaps why Wall Street analysts see Southwest Airlines swinging to a high of $0.65 in earnings per share (EPS) for the second quarter of 2025.

This forecast would imply a massive swing from today’s reported net loss per share of $0.18, so there is a large gap between where the stock could be trading and where it sits today.

Spotting this gap, some call option traders recently decided to fly into Southwest Airlines stock.

A Big Bet, Will it Pay?

As of mid-April 2025, nearly $1 million worth of call options were bought in Southwest Airlines stock. When investors consider that any options bet is subject to leverage, this $1 million bet is closer to being a multi-million-dollar swing bet, looking for the stock to see higher prices sooner rather than later.

Sooner is the key, and that is because these financial contracts have an expiration date. If the underlying stock’s price is not within the stipulated price, then a 100% loss is the result. Leverage and timing drive up the stakes of the underlying bet, so there must be a good reason to back Southwest Airlines despite a recession comment from its CEO.

The broader markets agree, as the stock now trades at a high price-to-earnings (P/E) ratio of up to 36.8x, a steep premium to the rest of the transportation sector’s average valuation of 13.1x. As mentioned in the breakdown of the options bet, markets typically have a good reason to overpay for any given stock.

That belief is that the stock will outperform its peer group and the broader markets, and Southwest has started to achieve that over the past quarter compared to its peers. Now that the market is aware of the real state of affairs in the airline industry, Southwest could accelerate to the top as its “safe haven” status becomes clearer.

But just how high can it go? As a first reference, investors can look to the company’s current price, which has traded down to 73% of its 52-week high. This creates a natural double-digit upside potential as sentiment starts to close the gap between the current price and future sentiment.