Ruchir Sharma writes, “American retail investors are all in, buying at an unusually aggressive pace this year. Roughly half of US household wealth is now invested in stocks — breaking the record set during the dotcom bubble of 2000. To the old line — never bet against the US consumer — might be added a new twist. Never bet against the US retail investor.”

Driving much of the strength in stocks is the hype around AI. “We are witnessing the emergence of a new version of the old central-planning fallacy—the belief that complex social systems can be optimized through technological intervention, much as software systems are engineered,” write Gary Saul Morson and Julio M. Ottino.

But is it entirely rational for expectations around AI to be so high when, as Gary Marcus notes, the most advanced models still can’t even play chess?

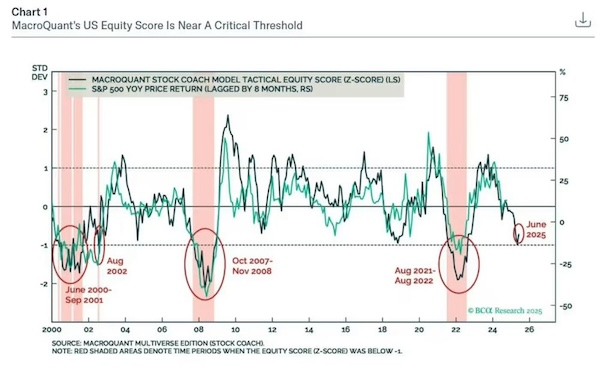

And while retail investors may not care at the moment, there are signs that suggest they should perhaps be a bit less sanguine regarding stock market risks. As Peter Berezin writes, “Our MacroQuant model is flagging the risk of a Wile E. Coyote moment for the .”

Meanwhile, there’s at least one market that is beginning to reflect the changing world equity investors appear oblivious to. “The dollar has tanked, even though the high rates that Trump dislikes should raise it. Its fall is driven by loss of confidence in US economic policies and institutions,” writes John Authers.