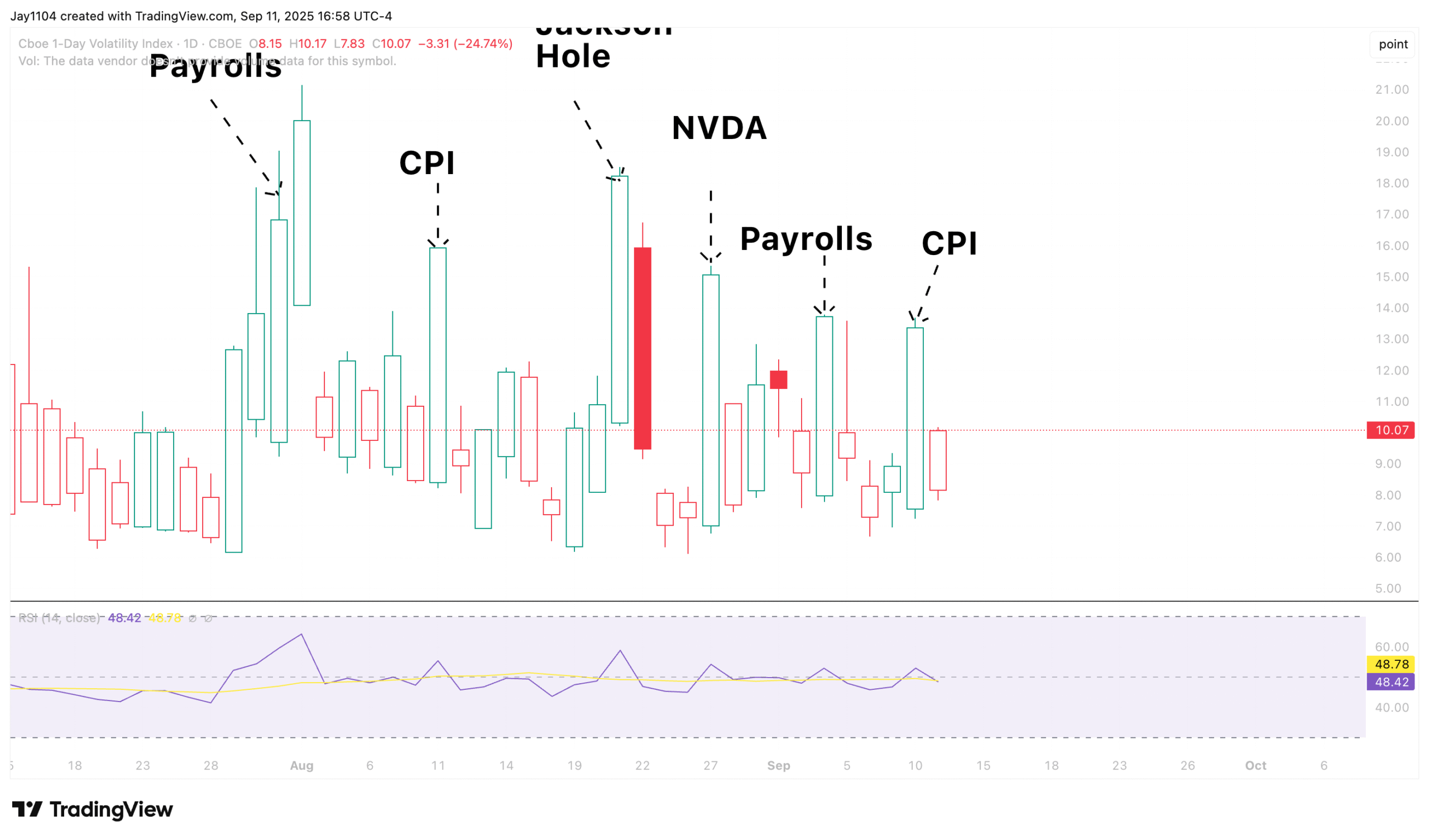

We did indeed get the volatility crush following the report. Nothing new. The move was muted to some degree because the closed at 13.4 on Thursday. The rule of 16 implies the market was pricing in an 84 bps move.

So I guess it’s no surprise that the rose by a stunning 85 bps. We see the same thing every time the VIX 1D gets elevated heading into an event. The funny thing is, I keep writing about it and reminding everyone.

The more interesting thing is that Amazon (NASDAQ:), Alphabet (NASDAQ:), Microsoft (NASDAQ:), Meta (NASDAQ:), Nvidia (NASDAQ:), and Broadcom (NASDAQ:) did absolutely nothing on the day.

Meanwhile, Tesla (NASDAQ:), Apple (NASDAQ:), and the other 492 stocks had to do the heavy lifting. I couldn’t begin to tell you what happens today. But with volatility reset and liquidity being an issue, it wouldn’t be surprising to see a much milder day. It might even give back Thursday’s gains, fill the gap from Thursday’s open, and find support around 6,540.

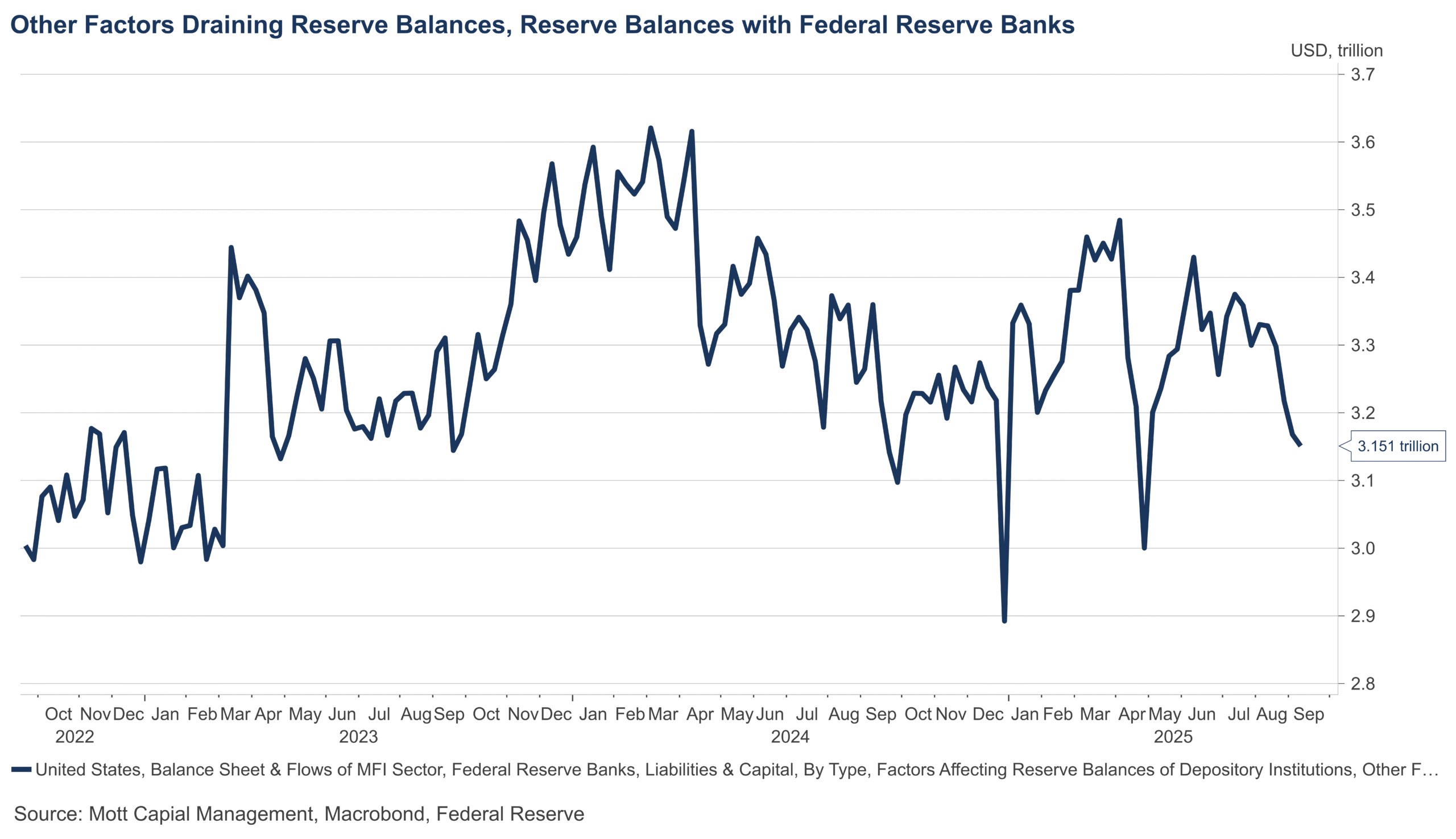

Reserve balances fell this week to $3.15 trillion from $3.16 trillion. The TGA dropped a bit on Thursday, which resulted in a slightly higher reserve balance than what had been tracking earlier in the week.

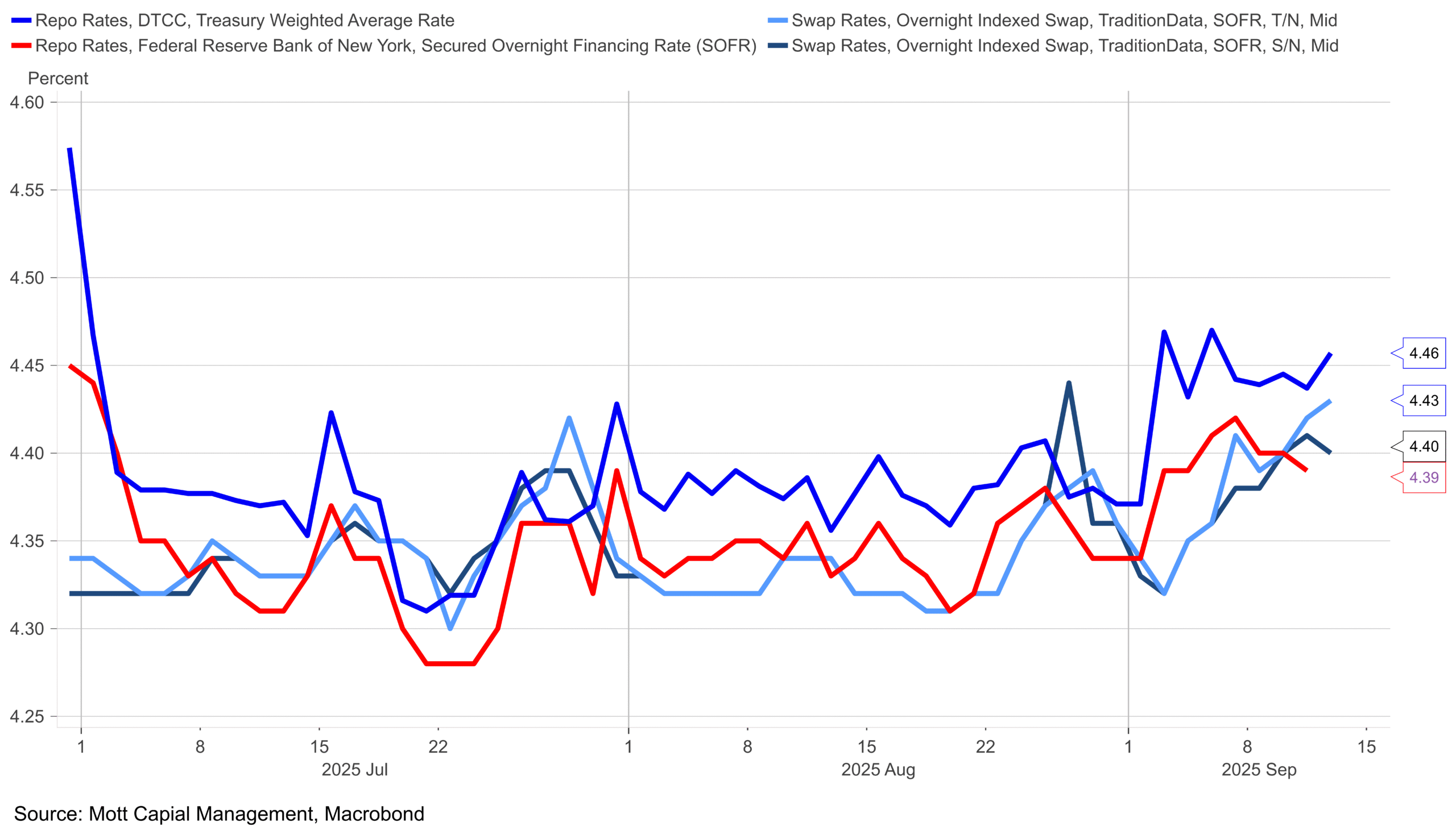

The effects of the TGA refill are being felt across the market complex. Overnight repo rates have moved higher, with SOFR rising as well. SOFR is likely to push back above 4.4% on Friday, given that the average repo rate was 4.46%.

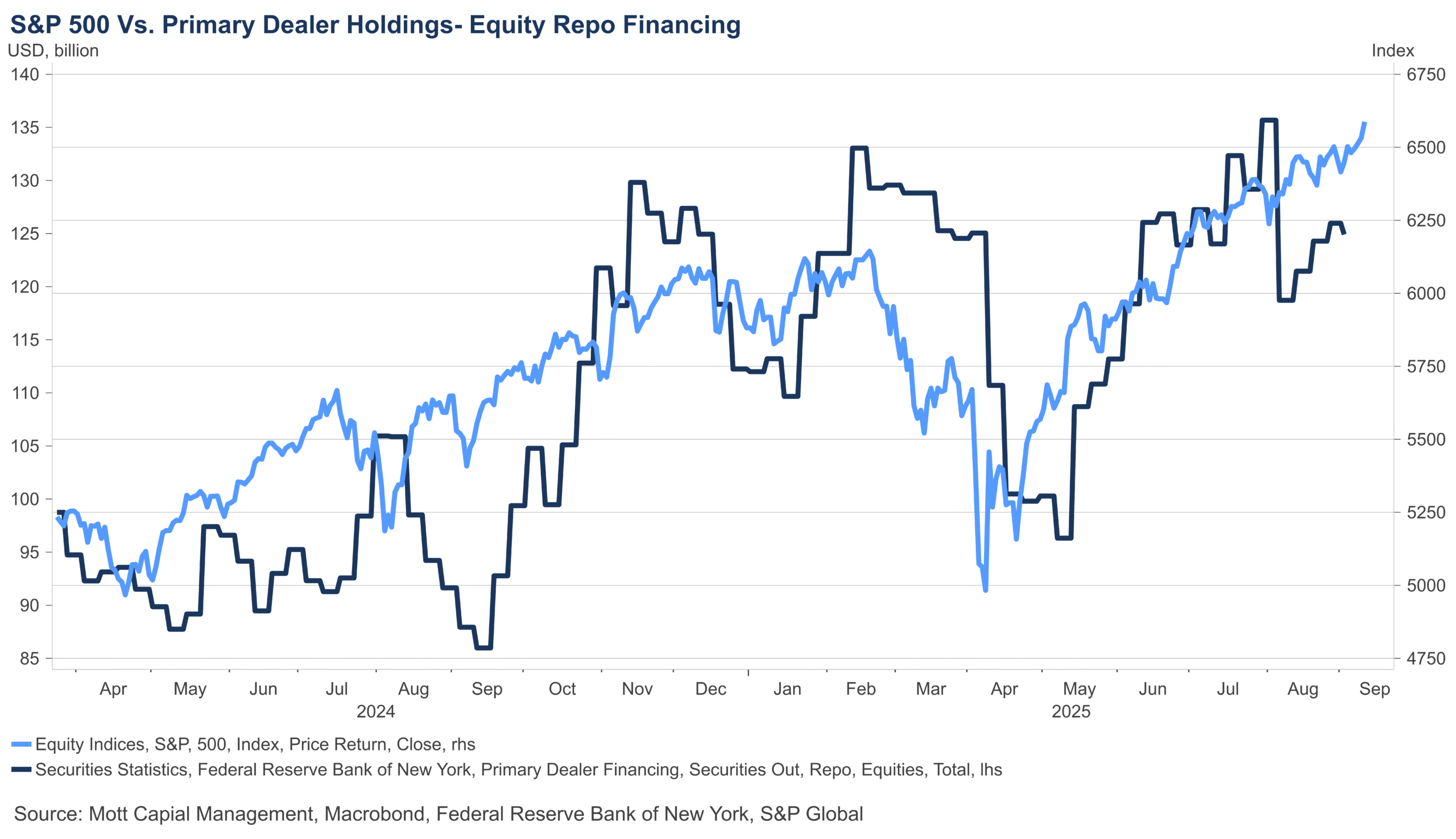

Meanwhile, equity repo financing activity has fallen sharply over the past couple of weeks. While it has rebounded off its lows, it still remains well below its highs.

Anyway, I’m really tired and drained. I’ll be back over the weekend.