Stocks rallied on Tuesday, managing to reclaim the losses from Monday. The rally appears to be one of those negative gamma rallies, that is, options-induced, and has more options-related hedging flows than anything else.

You could sense Monday night that the “powers” were setting up yesterday for something like this, with the 1% overnight gain that had no legs to stand on. We see this type of thing time and again, but I’m not sure if anything has changed.

More importantly, the yesterday reached the 10-day exponential moving average, and that is where it failed. So that appears to be resistance for now.

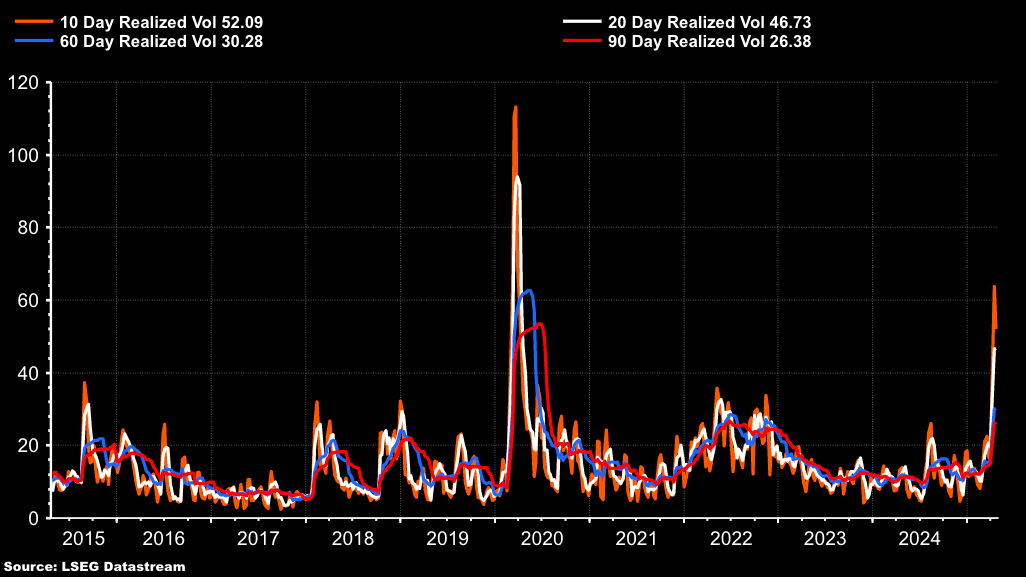

When you look at the index at 30 and see 10- and 20-day realized volatility at COVID-like levels. You can only help but wonder.

It’s almost as if the market is saying that all of this trade war-related uncertainty is going to vanish magically. Even the 60-day realized volatility is at 30.

So, you could see yesterday that at least 30 was acting as a floor for the VIX, which limited the S&P 500. It has been flat for a few days now, and as long as that is the case, I think the S&P 500 will continue to form lower highs and lower lows.

In the meantime, the weakened to 141.59, and it managed to survive a test of support, with a brief break below 140. Where the USD/JPY seems to go is what matters, and as of right now, we do not have a good answer. Most of the types of news we need that could break this stalemate won’t come until next week, unless there is additional tariff news.

Outside of that, I don’t think there was much else going on, just the usual daily noise.