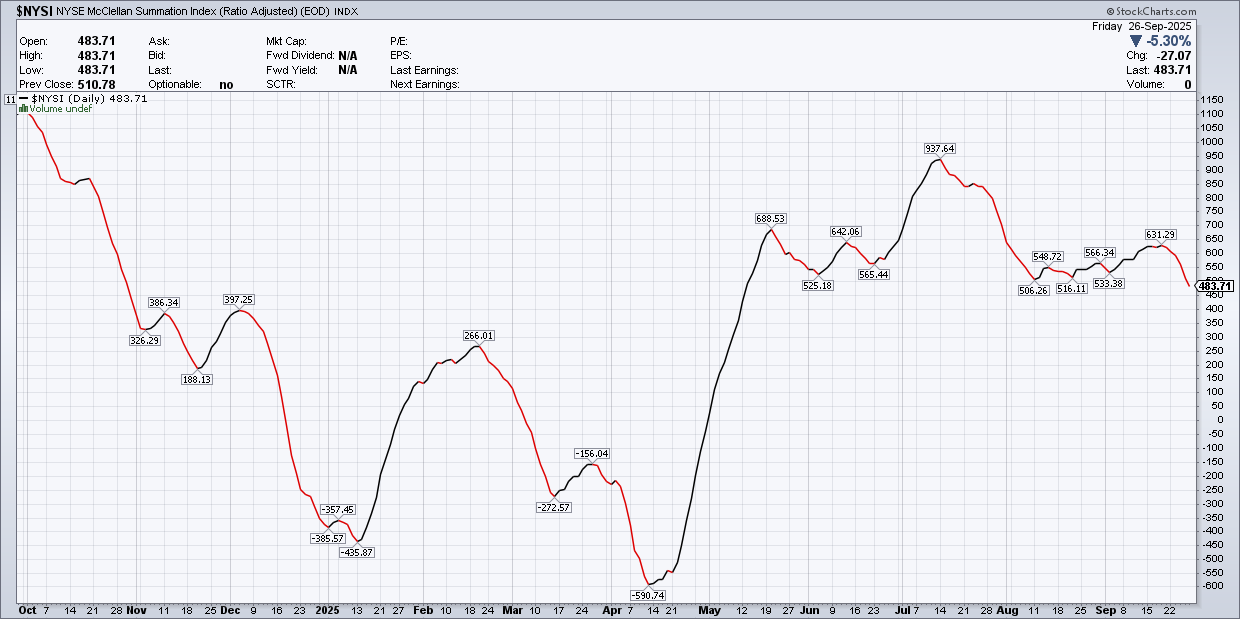

An interesting development occurred on Friday that bears are watching this week: the NYSE McClellan Summation Index fell below 500. From what I can tell, this is the first time the index has dropped below that level since May.

A drop below 500 doesn’t necessarily mark the end of the rally, but it does suggest the market’s advance may be running out of steam. If the Summation Index continues to weaken from here, it would signal that the odds of the rally continuing are fading. This will be something to watch as the week progresses, especially if breadth metrics remain weak.

Examining the chart, the Summation Index appears to resemble a head-and-shoulders pattern, with the index currently positioned directly on the neckline.

Friday, however, was a strange day of trading. The was up 55 bps, yet volatility, correlations, and the dispersion indexes all fell—an unusual combination. The one notable exception was that both 9- and 21-day realized volatility actually rose. It’s a good reminder that when realized volatility is this low, even a slight move in the S&P 500 can push realized volatility higher, which likely means implied volatility is near a floor.

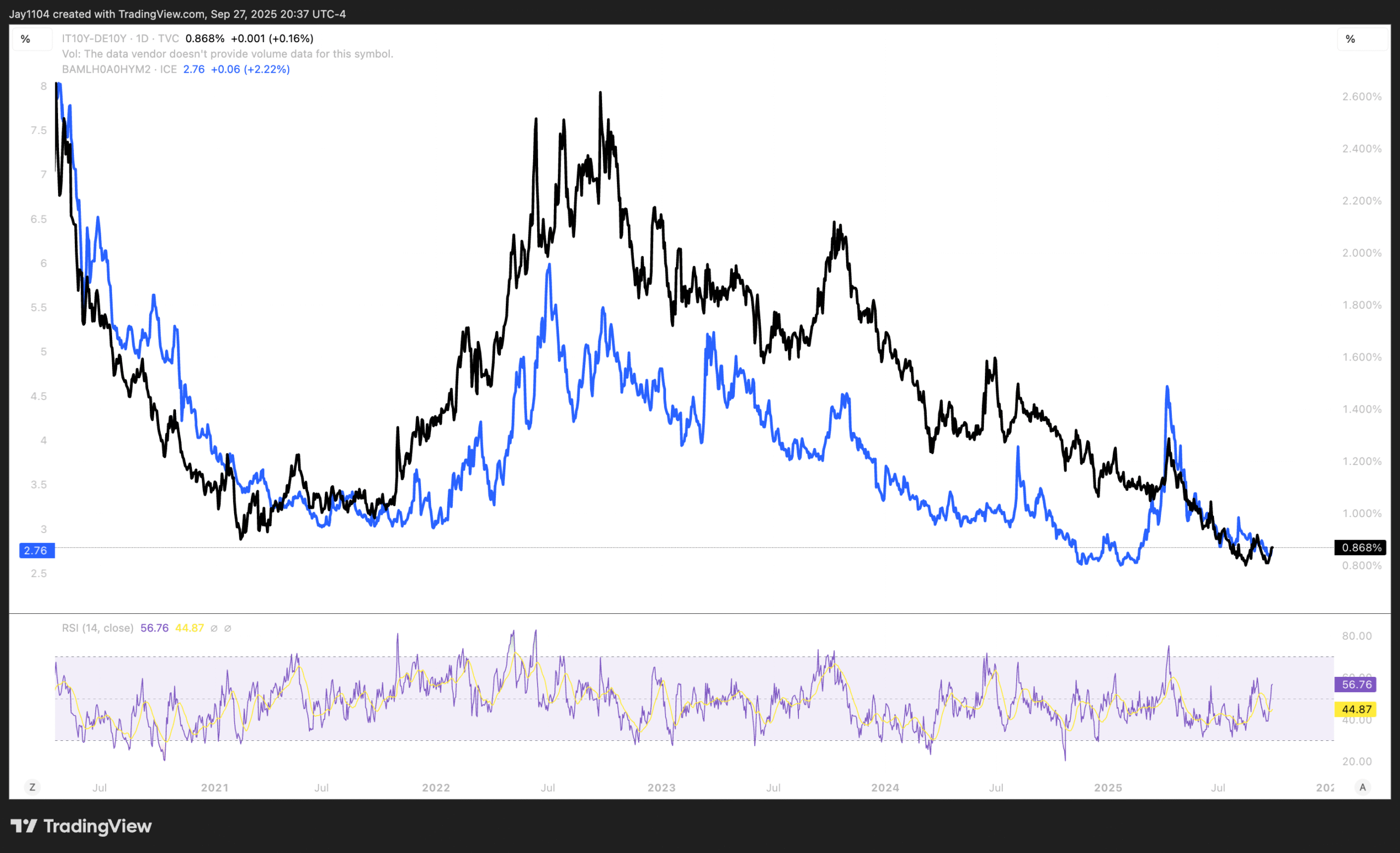

Another thing worth pointing out is that spreads in Europe have started to widen. The minus the has risen to 87 bps, which is still historically very tight but wider over the past few days. I’m not sure if the rules of the RSI apply to these types of sovereign spreads, but it has clearly formed a bullish divergence.

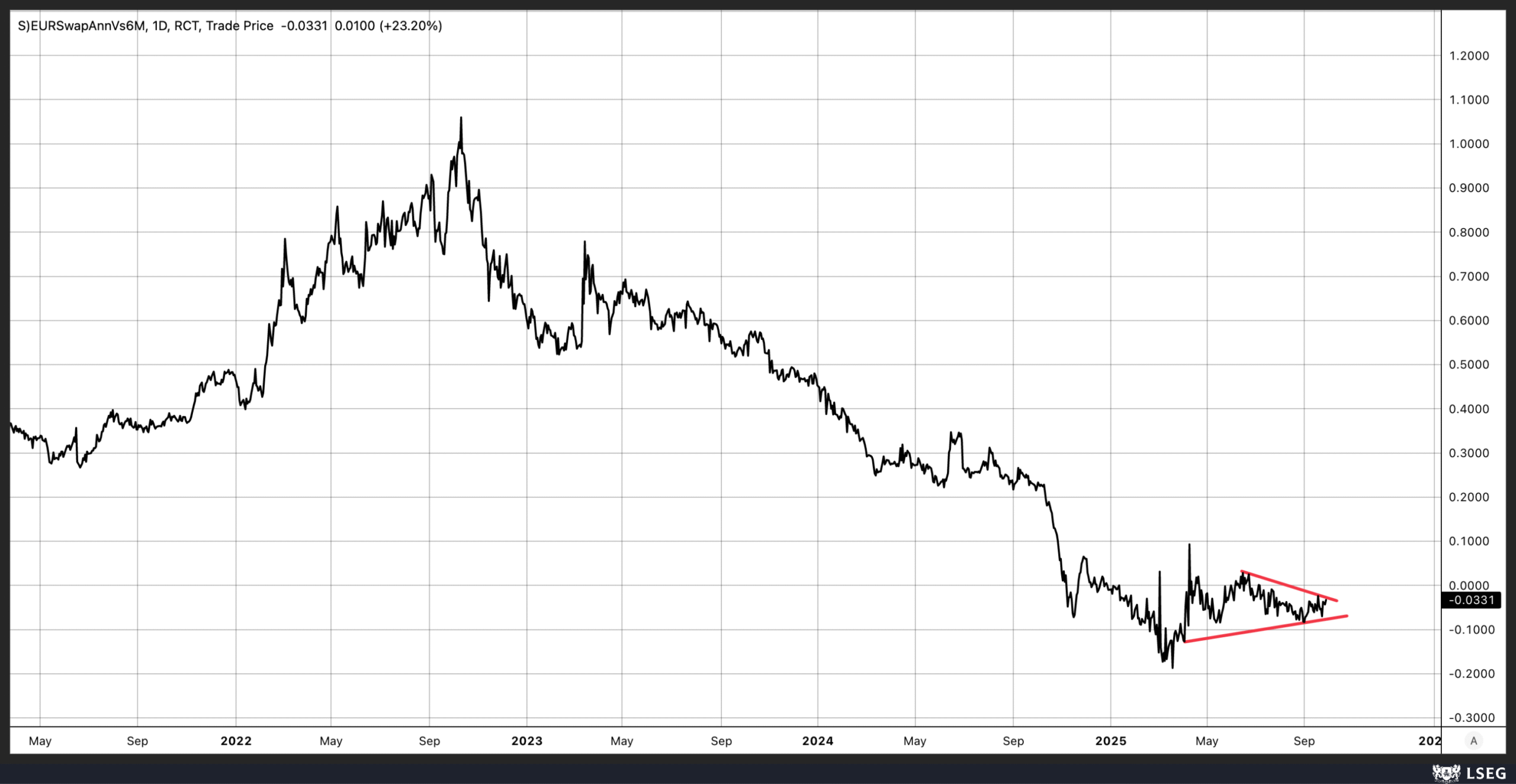

We have recently seen similar developments with the 10-year euro swap spread as well.

We care about spreads in Europe because high-yield credit spreads in the US tend to trade right along with changes in credit spreads in Europe. So if those spreads start to widen, there’s a good chance the spreads here in the US will begin to widen as well.

Some may find it surprising to see that HY spreads can trade right along with implied volatility levels for stocks.

Overall, with volatility this low and spreads this tight, it highlights the complacency and risks across not just the stock market but also the bond market. In some ways, it makes sense that spreads have tightened in Europe, given the shifting political landscapes in Germany and France, as well as the rising debt loads.

However, that doesn’t mean it makes sense for US high-yield debt to trade this tight to Treasuries. It seems possible, and even likely, that US credit spreads are picking up a false signal from Europe—failing to recognize that the tighter spreads there reflect increasing risks, not greater risk-taking.