The latest employment data strongly warned of a potential corporate earnings slowdown ahead. This is the first time we have warned about the employment data and its impact on corporate earnings. In May, we penned “” wherein we stated:

“Given the importance of consumption in the economy and that employment (production) must come first in the cycle, attention to employment data, particularly full-time employment, is crucial to determining economic risk. The risk of a recession remains very low; however, that can change if something causes consumption to contract quickly. Aside from an unexpected, exogenous impact, investors should expect economic growth to continue to slowly weaken to a longer-term trend slightly less than 2% annually. Unfortunately, while not recessionary, that growth rate will make it hard for corporate profitability to remain at record levels.”

The August 2025 employment report further confirmed the deceleration in job growth. added just 22,000 positions. Economists had expected over 75,000. June’s numbers were revised downward to a net loss of 13,000 jobs, the first monthly decline since 2020. July gained only a minor upward revision.

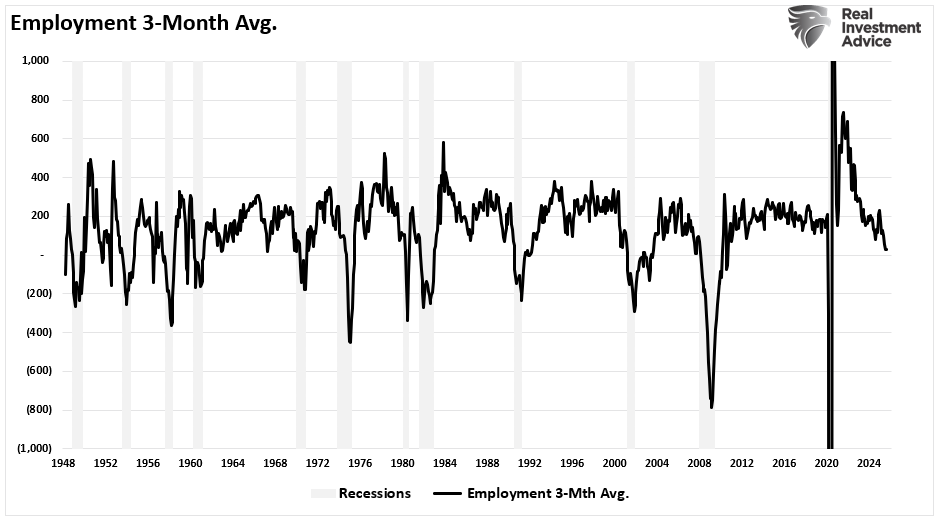

However, what is most important is the “trend” of the data rather than just a one-month data point. As shown, the 3-month average of employment is deteriorating sharply, which has only occurred previously just before the onset of a recession.

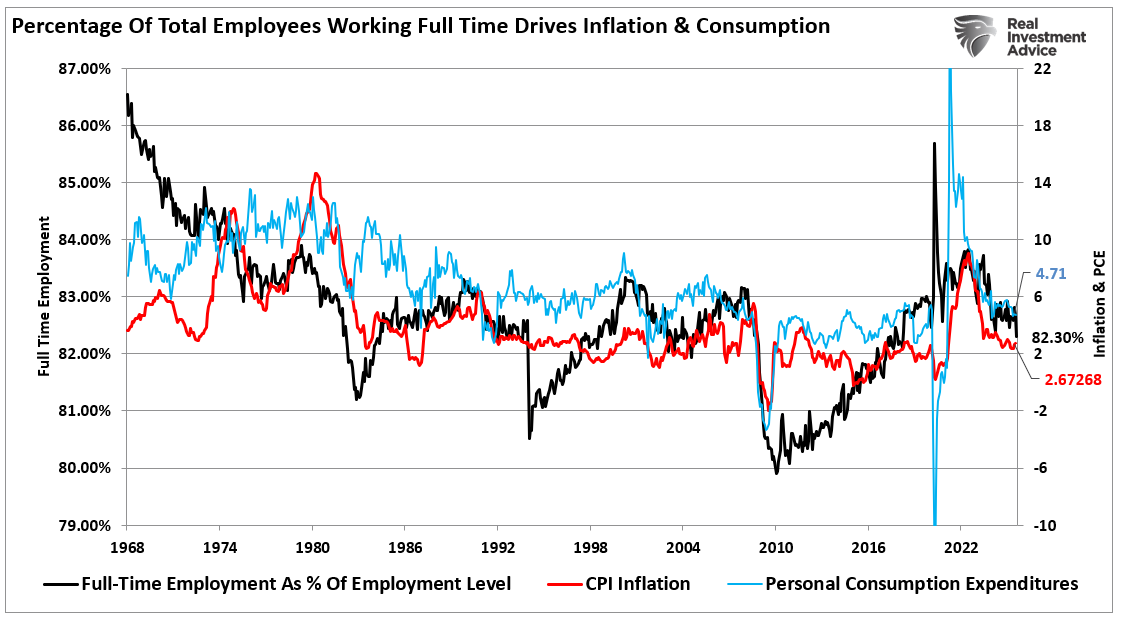

While the labor force participation rate was 62.3 percent, still well below pre-COVID levels, the percentage of total full-time employees continues to drop sharply. That data point is essential because full-time employment is required to sustain economic growth. With that level well below pre-COVID levels, it is unsurprising that economic growth rates are slowing.

It isn’t just slower economic growth that the latest employment report suggests. Yes, growth is slowing because jobs are shrinking, and as a consequence, households are spending less. As we showed in a recent #BullBearReport, economic growth, , and personal consumption are trending lower, given that employment, particularly full-time employment, supports economic supply and demand.

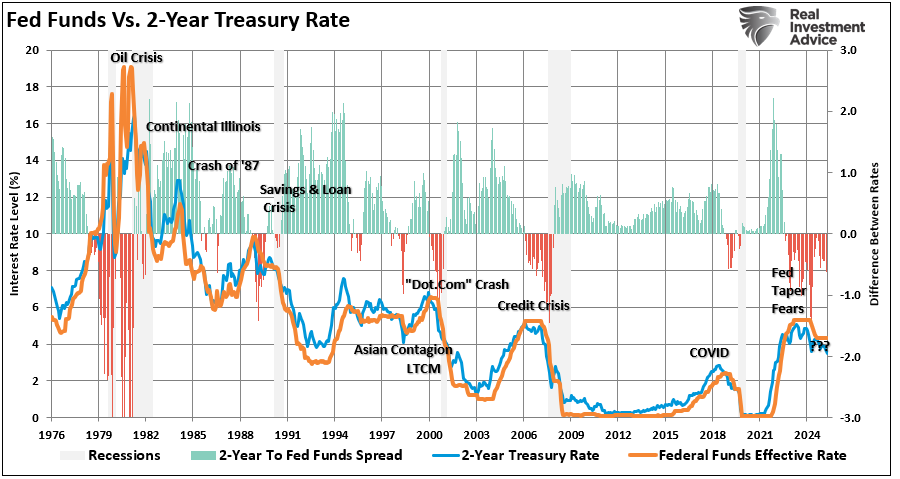

This data also confirms why the Fed is already behind the curve in .

Why the Fed Is Likely Behind the Curve

Despite the slowdown, the Federal Reserve remains hesitant. Chair Powell noted softening labor conditions at and suggested the door is open to rate cuts. But no concrete shift in policy has occurred. The Fed insists on being data-dependent while ignoring the most immediate data: labor markets are deteriorating. is not, and has not been a threat, and the two-year Treasury yield, a close approximation of what the Fed funds rate should be, is already more than 80-bps lower than the Fed’s current policy rate.

The latest also revealed soft hiring trends and growing caution among employers, with businesses pulling job postings and limiting expansion. That’s not a labor supply issue; it’s a demand issue. The Fed’s ongoing focus on lagging inflation data means that policies remain too tight and are now well “behind the curve.”

Markets aren’t waiting. Fed futures now imply near certainty of a September rate cut, with some traders pricing in 50 basis points. While many remain concerned about the risk of inflation, bond yields are already warning that the economic data is more disinflationary than not. As we have discussed before, despite all the “fear mongers” warning of surging interest rates, the reality is that interest rates on the long-end will track the economy. As we discussed in ”

“…let’s create a composite index of wages (which provides consumer purchasing power, aka demand), economic growth (the result of production and consumption), and inflation (the byproduct of increased demand from rising economic activity). We then compare that composite index to interest rates. Unsurprisingly, there is a high correlation between economic activity, inflation, and interest rates as rates respond to the drivers of inflation.”

We further discussed that relationship in “”

“The previous surge in inflation, and ultimately interest rates, was not a function of organic economic growth. It was a stimulus-driven surge in the supply/demand equation following the pandemic-driven shutdown. As those monetary and fiscal inflows reverse, that support will fade. In the future, we must understand the factors that drive rates over time: economic growth, wages, and inflation.”

With the economy and its primary driver, employment, slowing, the Fed’s delay in cutting rates increases the risk of a more substantial economic downturn. By maintaining rates at an elevated level, the negative impact on consumption (demand) is increasing. The Fed’s tightening has already filtered into credit, housing, and business spending. The labor market is reacting, and further policy lags will likely make the next easing cycle less effective.

The risk is that the central bank may be easing into a downturn it failed to prevent.

Implications for Corporate Earnings and Profit Margins

For investors, the most significant consequence is a slowdown in corporate earnings. A corporate earnings slowdown is already underway. Revenue growth is faltering, and companies, particularly in the retail and fast dining sectors, are seeing less pricing power as consumer demand slips. Eventually, those forces will compress profit margins. As we :

“While technology and AI-driven firms have recently become bright spots, their strength cannot offset broader corporate margin pressures. In Q2, S&P 500 earnings grew 6.4%, with 80 percent of companies beating estimates. But this masks a weakening breadth of growth, where earnings beats are concentrated in essentially just two sectors. There would have been no earnings growth without Megacap Technology and major Wall Street banks.”

While many firms relied on price hikes, labor efficiency, and cost-cutting to drive earnings growth this year, that playbook is limited in scope and becoming less effective. While Tech and AI-linked companies like Broadcom (NASDAQ:) have offered bright spots, the rest of the market is under pressure. Discretionary sectors, cyclical industrials, and small-cap firms are more exposed to demand shocks and slowing economic growth. While investors are currently ignoring the linkages between economic demand and corporate earnings, as margins erode, the impact on earnings will become more significant.

Currently, analyst estimates still assume robust earnings growth into 2026. However, that will change in the months ahead. As those earnings estimates are revised lower, the risk to the market, and currently very optimistic investors, is the question of valuations. As the corporate earnings slowdown accelerates, forward guidance will get cut, and paying significantly high multiples for earnings will be questioned. If companies revise down expectations, delay investments, and increase layoffs to protect bottom lines, the risk to markets will increase significantly.

Navigating The Risks

The evidence points to a slowing US economy. Growth is weakening, inflation remains elevated, corporate margins face pressure, and interest rate cuts are likely. These conditions require a shift in investment strategy. Investors must adapt to preserve capital, generate income, and manage risk. Positioning should emphasize resilience, quality, and income stability. The goal is to reduce exposure to volatile sectors and concentrate on assets that perform well during economic slowdowns.

Here are key actions investors should consider:

- Reduce exposure to cyclical stocks: Cut back on discretionary sectors like retail, travel, and consumer electronics that rely heavily on strong economic growth.

- Increase allocation to defensive sectors: Focus on consumer staples, healthcare, and utilities. These sectors provide stable earnings even in weak environments.

- Favor companies with strong pricing power: These firms can better maintain margins despite rising input costs.

- Prioritize strong balance sheets: Low debt and high cash reserves reduce financial stress and support consistent returns.

- Add high-quality dividend payers: Look for companies with a track record of stable or growing dividends. These provide income support as capital gains slow.

- Increase fixed income exposure: Short-duration bonds and high-grade corporates may benefit from falling interest rates.

- Consider yield curve positioning: A steeper yield curve from rate cuts may create an opportunity in intermediate bonds.

- Avoid speculative growth stocks. These firms rely on future earnings and cheap financing, both of which will be under pressure in a slowing economy.

A decelerating US economy changes the return profile across asset classes. Adjusting now to focus on quality, cash flow, and defensive positioning can improve downside protection and set the stage for more stable portfolio returns.

While there are no guarantees, the current gap between what Wall Street expects and what the economy can deliver is very different. Could the economy catch up to meet Wall Street’s expectations? Sure. It just usually doesn’t happen that way.

Most importantly, the Fed is late once again, and history suggests the impact on stocks will be negative.