Here is how US Treasury Secretary Scott Bessent characterized his negotiations with Chinese trade officials this past weekend: “We had very productive talks and I believe that the venue, here in Lake Geneva, added great equanimity to what was a very positive process.”

On Monday, the US and China agreed to suspend most tariffs on each other’s goods for 90 days.

Stock prices soared on this news, confirming that the two countries did more than just talk about trade negotiations. Bond yields also soared as fears that a trade war would cause a recession continue to recede. jumped because the global economy is now also less likely to fall into a recession. The (DXY) also rose.

Yes, it was a lovely weekend in Geneva.

The trade agreement means that reciprocal tariffs between China and the US will be cut from 125% to 10%. The 20% duties on Chinese imports relating to fentanyl will remain in place, meaning that total tariffs on China stand at 30%. China’s state-run media also set the table for Monday’s landmark announcement, calling the talks “constructive” and saying that negotiators “reached an agreement on establishing a China-US economic and trade consultation mechanism” for further discussions.

We’ve been writing that President Donald Trump is under pressure to declare a ceasefire in his trade war with countries around the world, especially with China. He has to avert a recession that could cost the Republicans their majorities in both houses of Congress in next year’s mid-term elections.

He also had to declare victory in his trade war before various cases were filed in several courts by plaintiffs who opposed his tariffs, who might rule that he didn’t have the constitutional power to unilaterally start a trade war without the consent of Congress.

In other words, our constitutional system of political checks and balances is working just fine. Also working are the financial checks and balances provided by both the bond market and the stock market vigilantes! Indeed, Trump attributed his 90-day pause on April 9 of his April 2 Liberation Day reciprocal tariffs to the bond market, saying growing concern over bond yields motivated his pause decision:

“I was watching the bond market. The bond market is very tricky; I was watching it. But if you look at it now, it’s beautiful. The bond market right now is beautiful. I saw last night where people were getting a little queasy.” Trump described investors as “jumping a little bit out of line” and “getting yippy, a little bit afraid,” indicating his awareness of the market’s unease before his tariff policy adjustment.

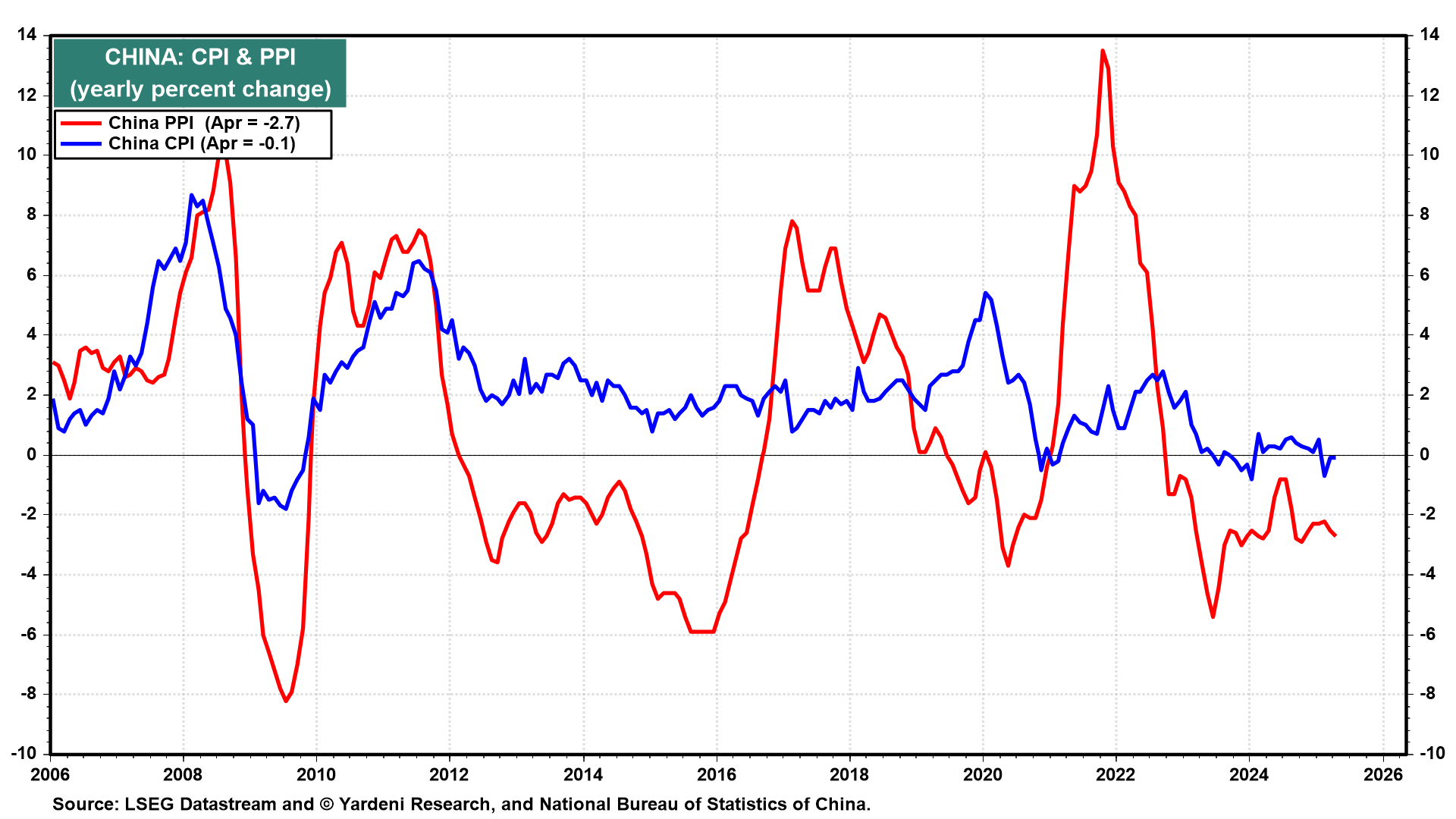

Fear of deflation might also be driving Chinese President Xi Jinping to negotiate a trade deal with Trump. On Saturday, May 10, just when the Geneva talks started, Reuters reported that China’s factory-gate prices posted the steepest drop in six months in April, while fell for a third month (chart).

The producer price index () dropped 2.7% y/y in April, worse than a 2.5% decline in March. eased 0.1% last month from a year earlier, matching a 0.1% drop in March.

On the U.S. front, stocks traded mixed on Tuesday as investors weighed cooler-than-expected inflation data and a fresh trade agreement between the world’s two largest economies.

The rose 2.3% year-over-year in April, slightly below expectations for a repeat of March’s 2.4% pace. This was the slowest annual inflation rate since February 2021. On a monthly basis, CPI increased 0.2%, rebounding from a 0.1% decline in March.