The begins 2025 with its weakest start since 1973 while the Swiss franc approaches its 2011 high of 1.3125 against the dollar. Each week, the Syz investment team takes you through the last seven days in seven charts.

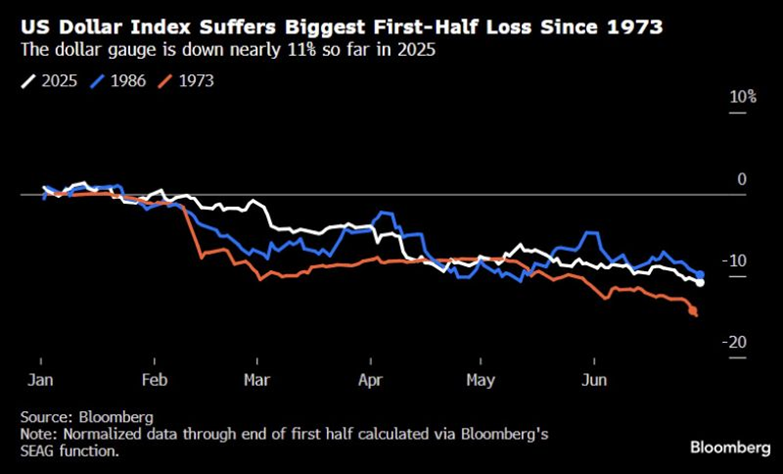

1. The Worst Start of the Year for the Dollar Since 1973

The US dollar experienced its most significant first half drop in over 50 years, as unpredictable policy changes and indications of a slowing economy undermined trust in the world’s primary reserve currency.

During the first half of 2025, the (DXY) dropped by 10.8%, reflecting a sharp decline against major developed-market currencies. The Greenback fell by 14.4% against the , 13.8% against the , and 9.7% against the . Meanwhile, emerging-market currencies surged, marking some of their strongest performances in recent years.

Source: HolgerZ, Bloomberg

2. Don’t Forget, FX Effect Is a Very Important Component in Total Returns…

As Jeroen Blokland, founder of True Insights, pointed out, although the is nearing record highs when measured in U.S. dollars, it has dropped by 11% from its February peak when viewed in euros.

The euro has climbed to its strongest level since September 2021, negatively impacting returns for investors using the euro as their base currency.

Source: Bloomberg, Jeroen Blokland

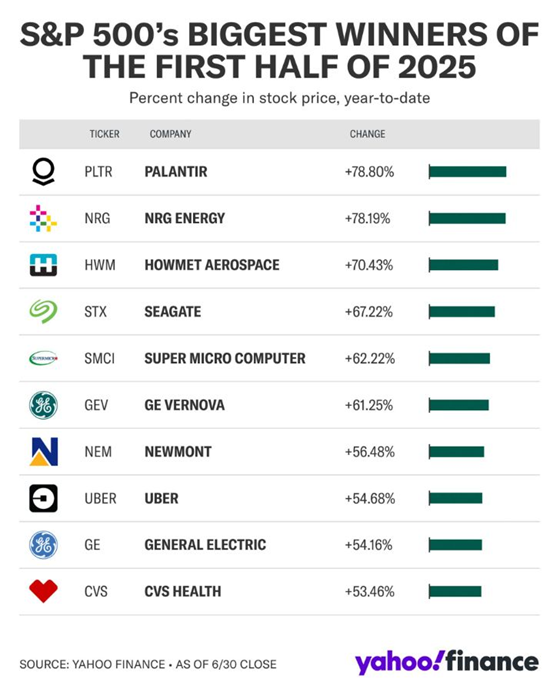

3. Here Are the Best-Performing S&P 500 Stocks From the First Half of 2025

Here’s the Top 3:

- Palantir (NASDAQ:) +78.8%

- NRG Energy (NYSE:) +78.2%

- Howmet (NYSE:) +70.4%

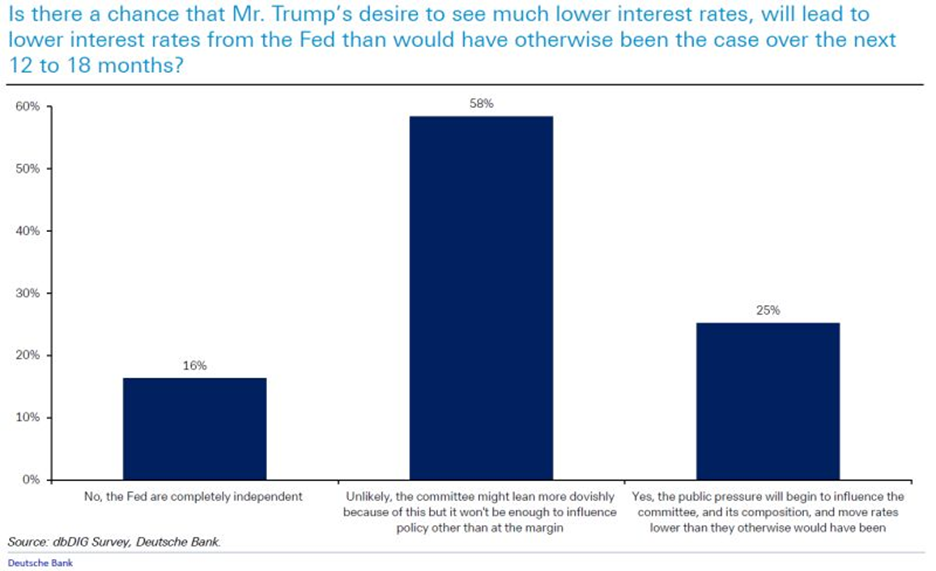

4. Investors Don’t Believe in Fed Independence Anymore

According to a recent survey by Deutsche Bank, just 16% of participants believe the Federal Reserve operates with full independence, while 25% think political influence is pushing the central bank toward cutting .

Source: DB thru Liz Abramowicz

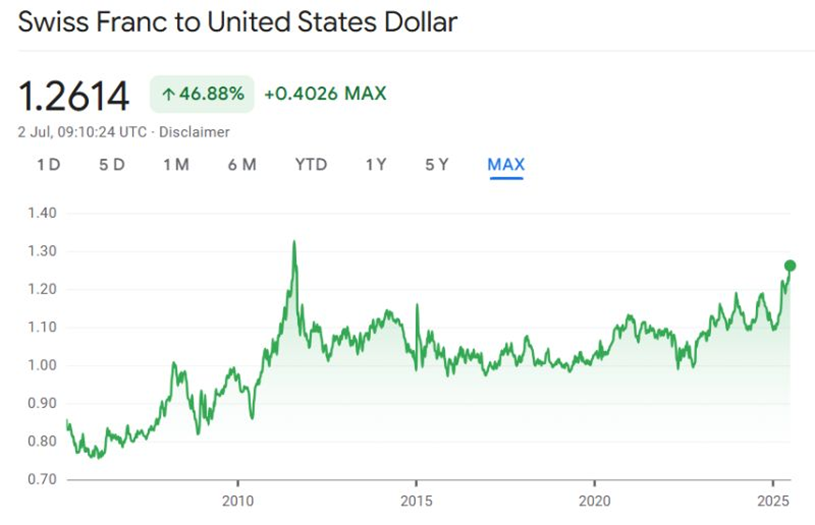

5. The Swiss Franc Has Appreciated Against the Dollar by Nearly 50% Over the Last 20 Years

An appreciating Swiss franc presents considerable difficulties for Swiss companies, especially exporters, by weakening their ability to compete on price internationally. This may squeeze corporate profit margins and weigh on Switzerland’s economic growth.

It’s also worth noting that the August 2011 peak of 1.3125 is approaching. If that level is breached, how might the Swiss National Bank respond? Heavy use of its balance sheet (at the risk of being pointed out by Trump as a currency manipulator) and/or negative interest rates?

Source: GoogleFinance

6. The IBM Revival

stock has surged over the past 18 months, surpassing its long-standing market capitalisation ceiling of around $250 billion, previously reached in 1999 and 2012. What’s behind this remarkable resurgence for the iconic firm?

The turnaround is largely attributed to its effective pivot toward enterprise artificial intelligence (AI) and hybrid cloud technologies, strategic moves that have fuelled solid financial results and bolstered investor trust.

Source: Bloomberg, HolgerZ

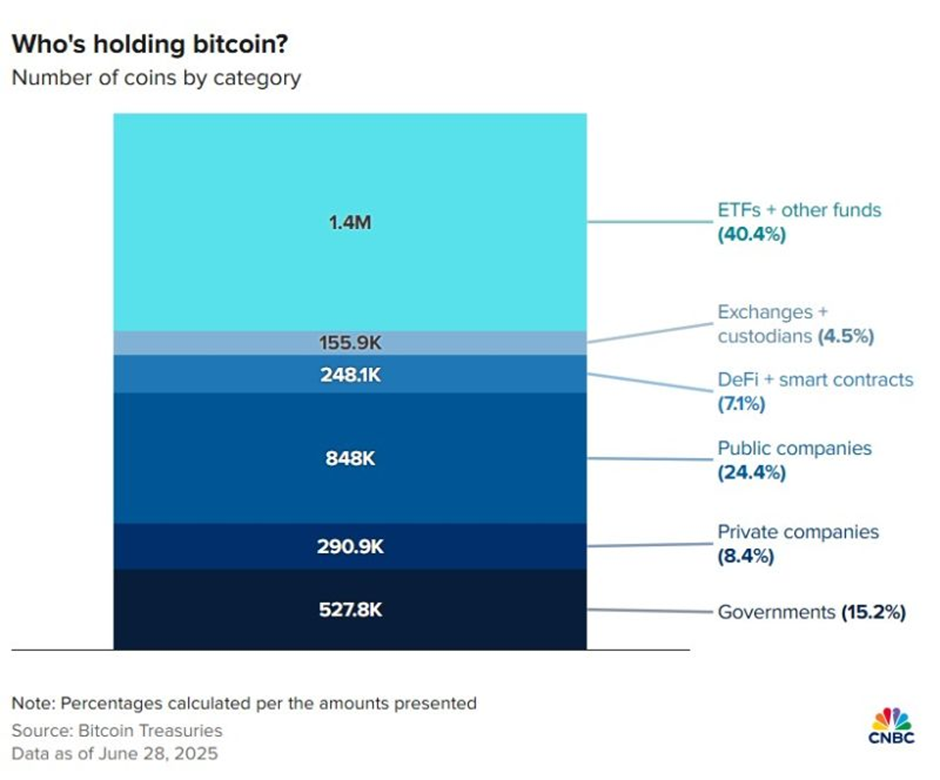

7. Who’s Holding Bitcoin?

ETFs, which saw one of the most successful ETF launches in U.S. history in January 2024, remain the largest institutional holders of bitcoin, with over 1.4 million coins—approximately 6.8% of the total 21 million supply.

Meanwhile, publicly traded companies hold approximately 855,000 bitcoins, making up around 4% of the fixed supply.

Source: CNBC