- Israel-Iran conflict continues; US considers joining in

- Dollar slips as risk appetite slightly improves

- Oil maintains its recent gains, but gold fails to benefit

- Pound pressure lingers as BoE meets on Thursday

Israel-Iran Conflict in the Spotlight

Trading sessions that feature the pivotal meeting tend to be dominated by expectations of possible monetary policy amendments and rhetoric changes. This is not the case today, as the unraveling Israel-Iran conflict is firmly in the spotlight.

While both sides continue their tit-for-tat strategy, the key question is whether the US will join this conflict on Israel’s side. Trump’s commentary has shifted since Friday, with both commentators and Israeli sources now pointing to an imminent involvement of the US over the next 24-48 hours, also based on aircraft and ship concentrations in the area. Notably, such a move would undermine a long-standing argument of Trump supporters that the current US President does not start wars but ends them.

While Israel’s stated target is to completely annul Iran’s nuclear capabilities, PM Netanyahu also appears to be in favour of a regime change in Iran via military means. French President Macron has already criticized this alleged effort, but the wheels have probably already been set in motion, potentially changing the status quo in the region dramatically.

Risk-Off Reaction Benefits the Dollar

Yesterday’s session was characterized by risk-off tone, with the recording decent gains across the board, and both equity and crypto markets feeling the pressure. This sentiment reversed overnight, with risk assets getting a small boost, but failing, so far, to completely recover their previous losses.

With the risk of Iran blocking the Hormuz Strait rising, remains the main protagonist of the current movements, experiencing a 10% rally since Friday and outperforming other key market assets. The higher risk premium is also reflected in option-based implied volatility, with the one-month indicator jumping to a new 30-day high. Interestingly, ’s reaction has been much more muted, with the precious metal trading sideways, within a tight $3,365-$3,410 area.

Fed Is Meeting Today

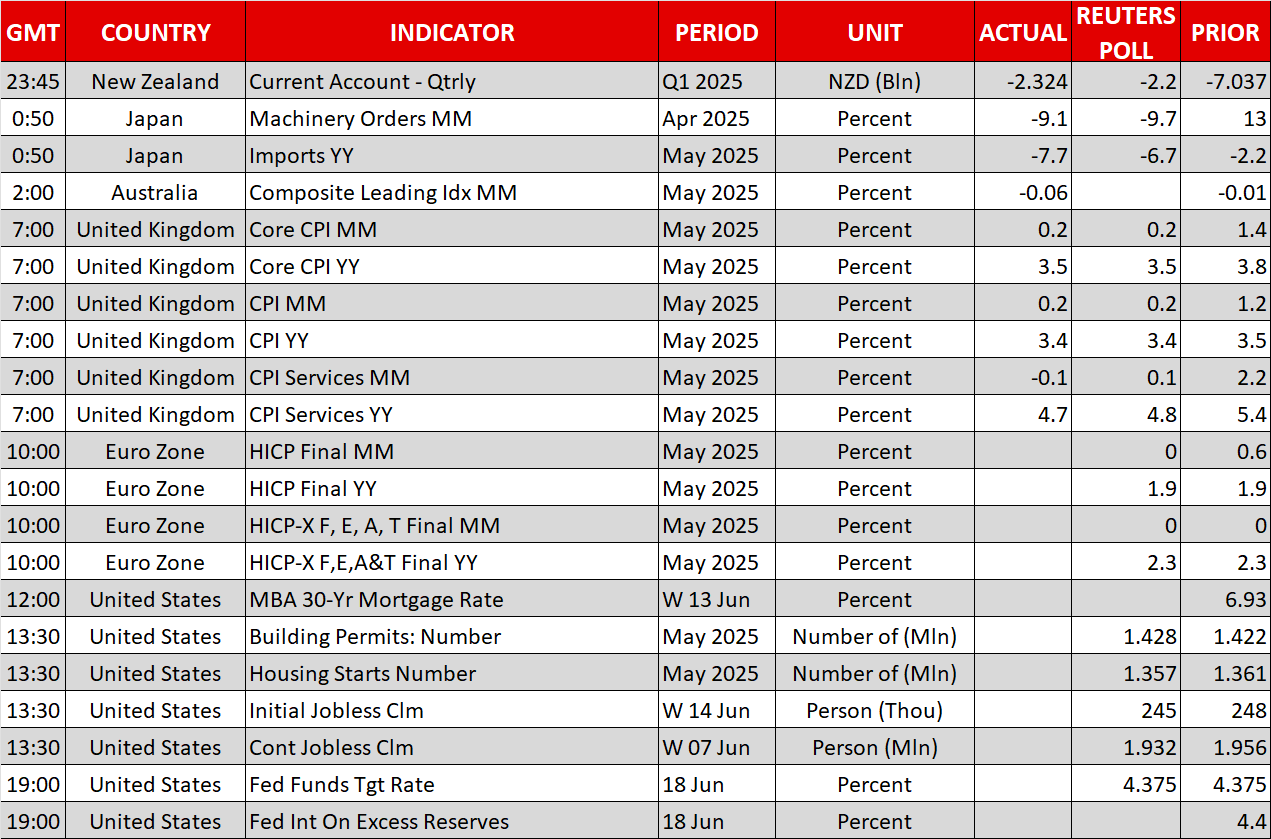

Amidst these developments, the Fed will announce the outcome of its rate-setting meeting at 18:00 GMT. A rate cut is not on the cards, with the market assigning just a 1% probability of such a move today. The first 25 bps rate reduction is currently expected in October.

Assuming a unanimous rate decision today, both the usual dot plot and the press conference are expected to get a fair share of attention. Notably, economists are divided over the possibility of the dot plot, which presents FOMC members’ expectations about the future path of interest rates, showing one or two rate cuts in 2025.

Interestingly, the chances of Fed Chair Powell maintaining the current balanced approach are high. While the mixed economic data prints might have tentatively opened the door to a more dovish stance going forward, developments on the tariffs front and the escalation seen in the Middle East will probably keep Powell’s hands tied for now.

While dollar bulls would welcome a hawkish meeting and a dot plot showing one rate cut in 2025, the greenback’s reaction remains a mystery following its recent trend that has upset well-set historical patterns. Although put aside over the past few days, Trump’s tariff strategy and the lack of trade deals will most likely continue to overshadow demand for US assets.

Pound Seeks Direction After Soft CPI Report

While the size of Thursday’s is still up for discussion, the BoE is not expected to amend its monetary policy stance tomorrow. Apart from the mixed UK data – today’s report showed a slight deceleration in inflationary pressures – MPC members have also to take into account the ONS’s data issues and the ongoing Israel-Iran escalation, making Thursday’s decision tougher. A dovish tilt could be on the cards if the Fed makes a similar adjustment to its rhetoric on Wednesday, clouding the pound’s outlook even further.