- One big factor weighing on DXY is the lack of clarity about what the tariffs are ultimately meant to accomplish.

- The lack of a consistent message about the primary purpose driving the aggressive tariff regime has left traders, businesses, and global policymakers more uncertain than ever.

- DXY remains in a clear downtrend (lower lows and lower highs).

After an impressive rally over the last week, US indices are back near unchanged on the month, with a few days left until we flip the calendars to May. While US stock market bulls may be (at least momentarily) relieved by the recovery, the hasn’t fared nearly as well.

The greenback staged a strong 1-day rally off 3-year lows last Tuesday, but the world’s reserve currency hasn’t been able to build on that momentum. Instead, the (DXY) has retraced about half of that rally over the last few trading days, failing to establish a foothold above the 100.00 level.

…So what gives?

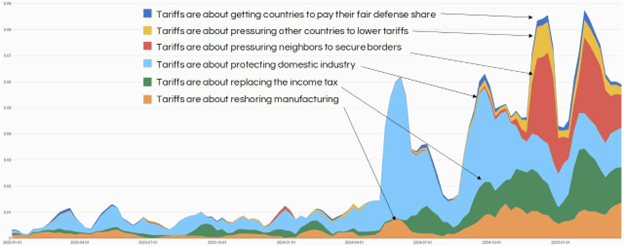

Outside of the general “decline of US exceptionalism” narrative that we’ve covered repeatedly over the last few weeks, one big factor weighing on the greenback is the lack of clarity about what the tariffs are ultimately meant to accomplish. As the chart below shows, the narratives justifying tariffs have rotated from “protecting domestic industry” to “pressuring countries to pay for defense / lower their own tariffs / secure borders” to “reshoring manufacturing” to “replacing the income tax”:

Source: Second Foundation Partners

The lack of a consistent message about the primary purpose driving the aggressive tariff regime has left traders, businesses, and global policymakers more uncertain than ever. Without clarity about how tariffs could be reduced (or whether that’s even reasonable), it’s arguably more difficult than ever to map out how the global economy will look in the next month, year, or decade.

Just this weekend, US President Trump took to Truth social to proclaim that “When Tariffs cut in, many people’s Income Taxes will be substantially reduced, maybe even completely eliminated…THE EXTERNAL REVENUE SERVICE IS HAPPENING.”

Putting aside the long-term feasibility of that plan, the suggestion that substantial tariffs will remain in place (indefinitely?) is weighing on the outlook for global trade and economic growth more broadly.

Faced with this immense uncertainty on a month-to-month, week-to-week, or even day-to-day basis, forex traders are opting out of owning US dollars at the margin, preferring instead to park their funds in currencies where they have more certainty about future policies. The longer this ambiguity remains, the more difficult it will be for the US dollar to sustain any sort of sustainable rally.

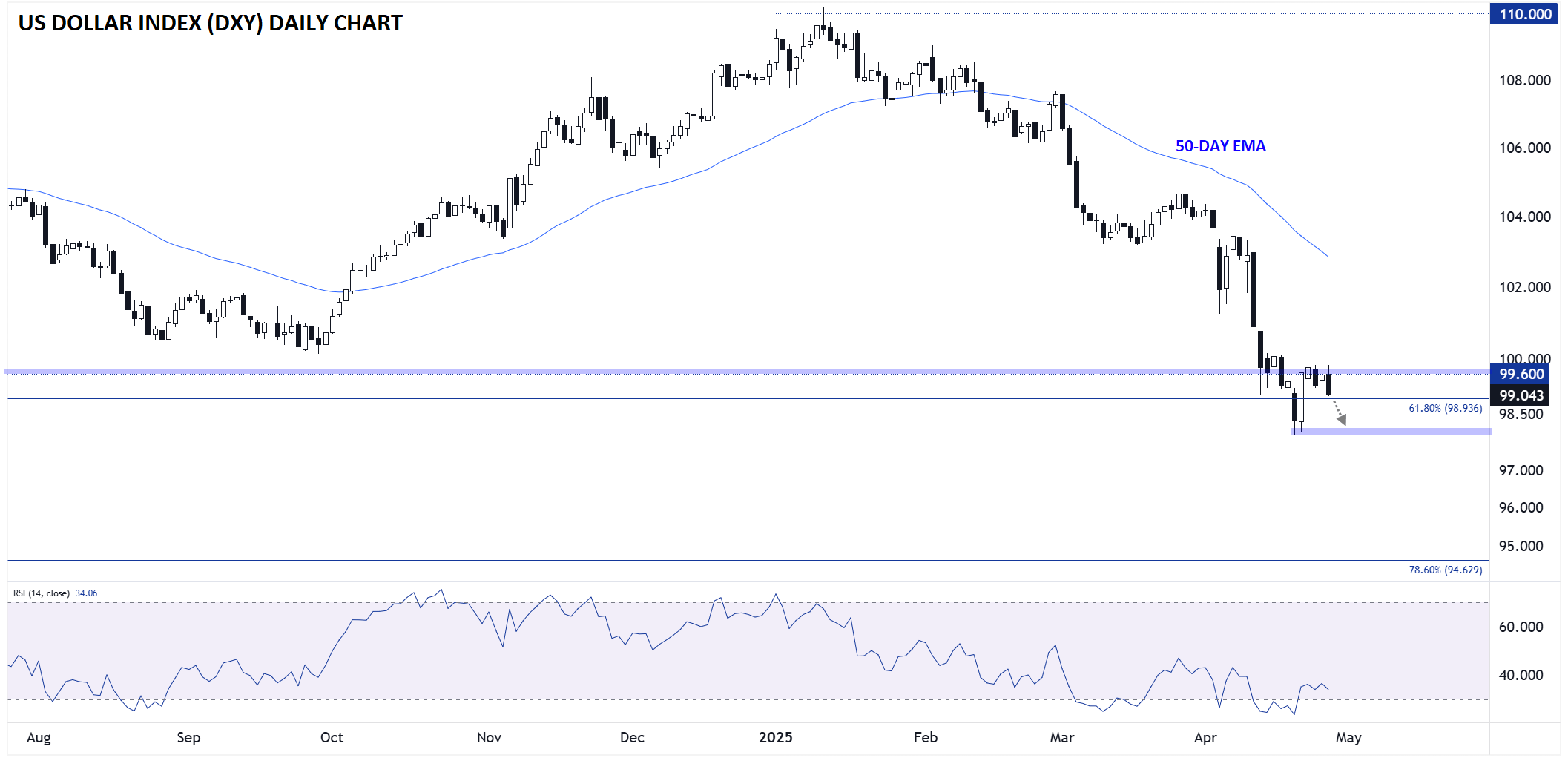

US Dollar Technical Analysis: DXY Daily Chart

Source: TradingView, StoneX

Turning our attention to the chart, the US Dollar Index (DXY) remains in a clear downtrend (lower lows and lower highs). From a longer-term perspective, the index sits near the 61.8% Fibonacci retracement of its 2021-2022 rally, but hasn’t seen a meaningful bounce from that potential support level.

If the dollar continues to fall from here, the next major test will be at last week’s lows around the 98.00 handle, and if that minor support zone is broken, there’s little in the way of meaningful support until the next long-term Fibonacci retracement closer to the 95.00 handle.

Meanwhile, a semblance of certainty around the purpose of US tariffs and their outlook moving forward could finally put a floor under the world’s reserve currency, though traders would likely need to see DXY establish a secure foothold above the 100.00 level before considering medium- or longer-term bullish trades.