lands soon, but US data is steering . Rate-sensitive moves suggest spending and income figures matter more. Japan may take a back seat.

- USD/JPY breaks higher as U.S. data reinforces short-end rate sensitivity.

- Fed cut expectations unwind, giving bulls fresh momentum.

- Tokyo CPI unlikely to shift the dial unless it delivers a major surprise.

- Watch Fed speakers post-PCE for clues on policy direction.

USD/JPY Outlook Summary

Upside risks flagged for USD/JPY in our weekly outlook guide have materialised nicely, with the pair breaking higher on Thursday following a string of stronger-than-expected U.S. economic data. Right now, correlation analysis reveals it’s U.S. interest rates driving the price action, particularly the front end of the curve, where the relationship has been extremely tight over the past fortnight.

If that continues, it suggests the U.S. for August, rather than Tokyo CPI data for September, looms as the most likely risk event to generate volatility on Friday.

Fed Pricing Driving The Price Action

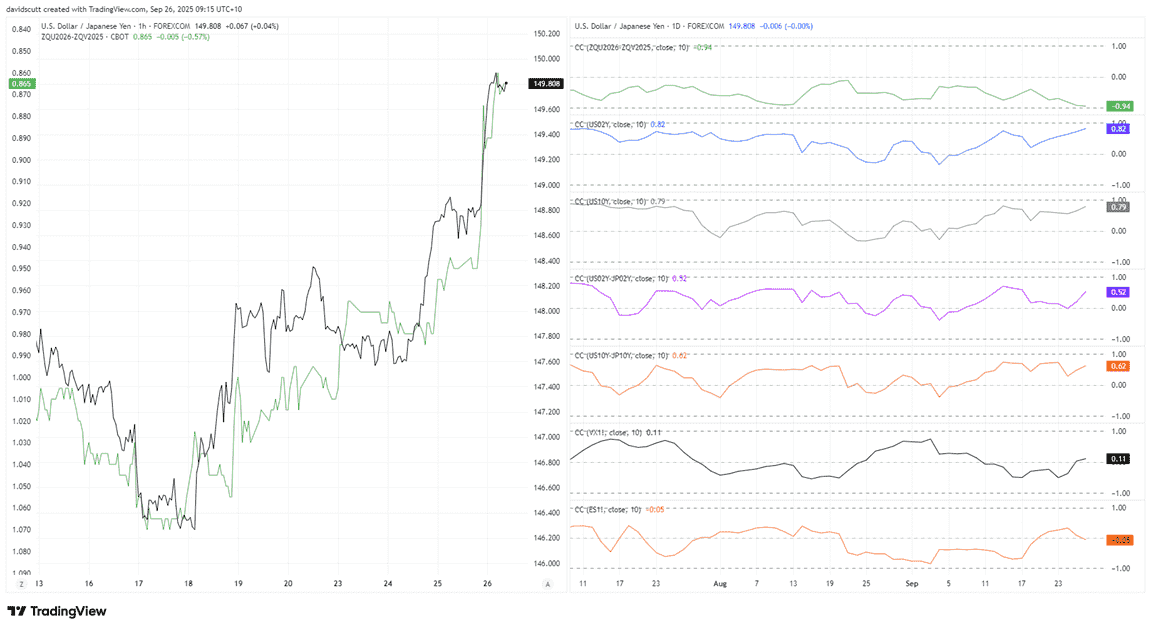

Market pricing for Fed rate cuts is driving USD/JPY, as demonstrated by the correlation coefficient of -0.94 with the shape of the Fed funds futures curve between October 2025 and September 2026, shown in green in the chart below. The left-hand pane visualizes the relationship, inverting the scale of Fed pricing over an hourly timeframe to show just how tight it’s been.

Slightly weaker readings have been seen with two- and U.S. Treasury yields over the same period, shown in blue and grey, respectively. In contrast, U.S.-Japanese yield differentials over the same tenors—along with other traditional drivers such as risk appetite and volatility measures—have shown far weaker or no relationship at all.

Source: TradingView

U.S. Data Is Therefore Key

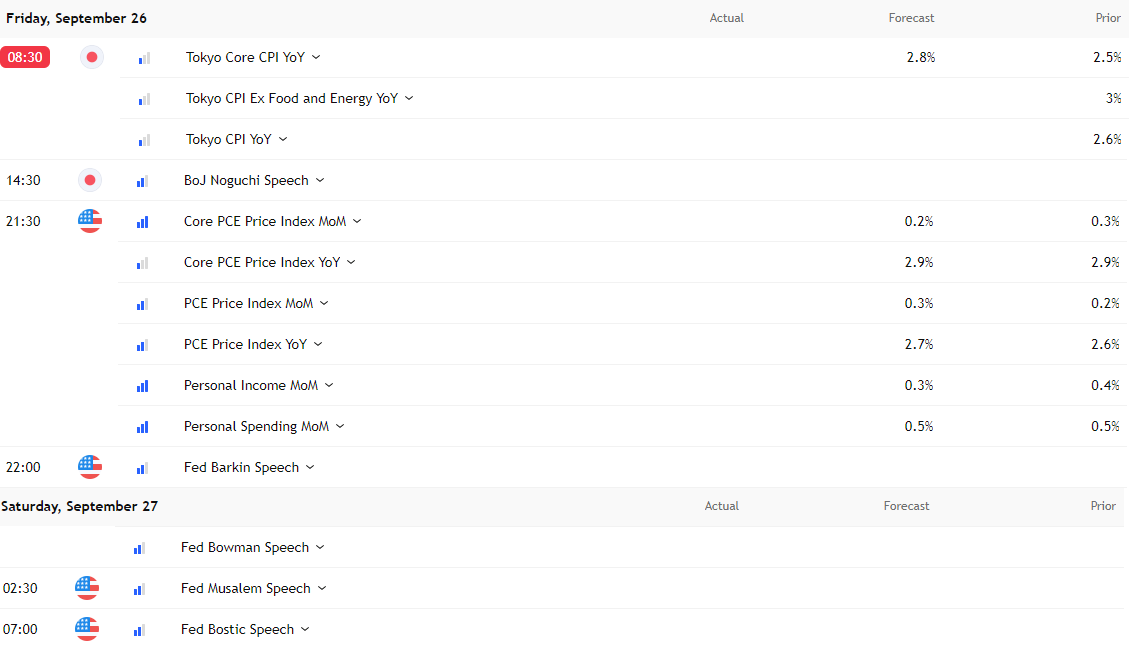

This points to U.S. data being the most likely catalyst to spark volatility in USD/JPY on Friday, barring a shock outcome from Tokyo CPI released at 8:30 a.m. in Japan. , which excludes fresh food prices, is expected to accelerate to an annual pace of 2.8%, up from 2.5% in September. Core-core CPI, which also strips out energy prices, is forecast to moderate to an annual clip of 2.8%, down from 3% previously.

After two board members voted for a 25 basis point rate cut last week, watch for any remarks related to the data from BOJ board member Asahi Noguchi, who voted to keep the overnight rate unchanged at 0.5%.

Source: TradingView

Realistically, the U.S. calendar screens as more significant for USD/JPY today given the strong linkages to short-end —but not necessarily the deflator. While it may be the Fed’s preferred underlying inflation measure, it rarely delivers major surprises nowadays.

A stronger signal on future domestic inflationary pressures may instead come from separate spending and incomes data released within the report. If strong, it will further weaken the case for rate cuts given we’re talking about the largest and most important component of the U.S. economy.

Whatever the details, pay extra attention to Fed speakers scheduled after the data is released. If there’s a message to be sent, it will likely come via those speeches rather than appearances beforehand.

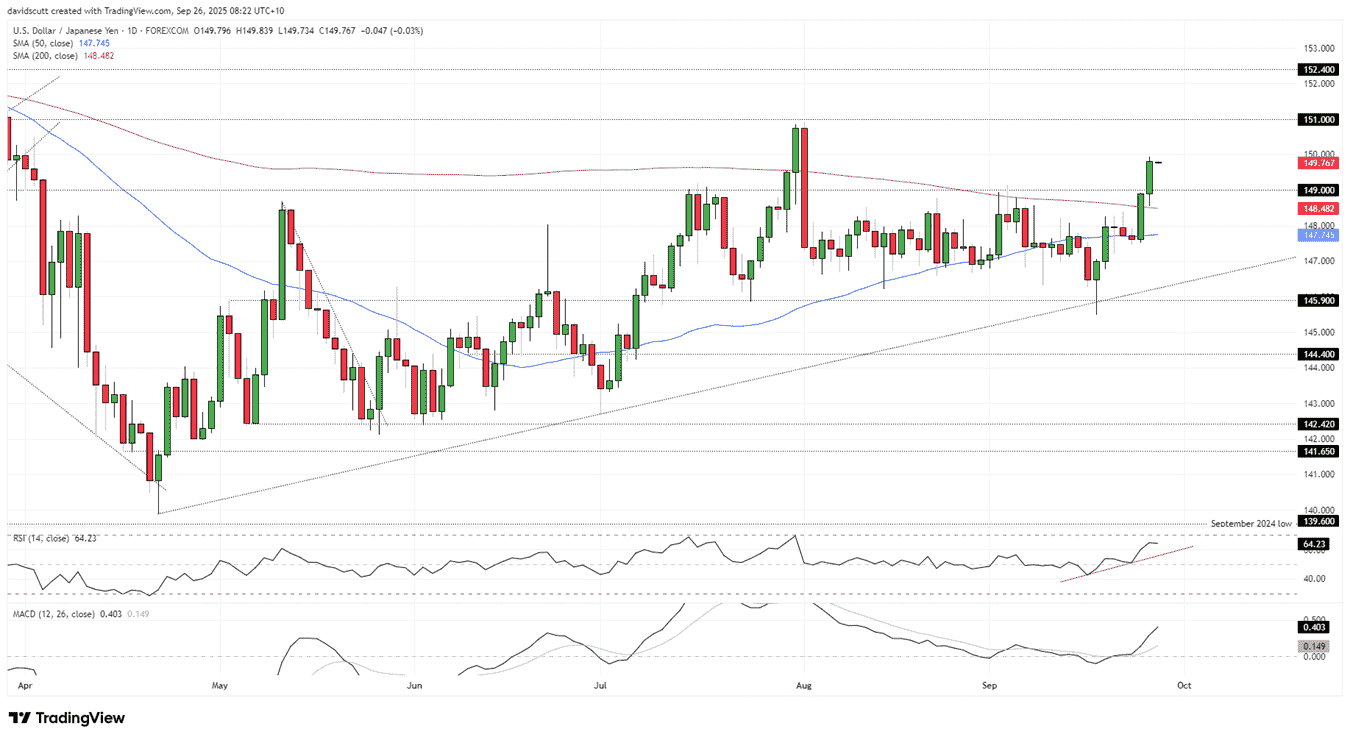

USD/JPY Breaks Higher

Source: TradingView

With pricing dwindling, USD/JPY has finally broken out of the sideways range it was stuck in since the July payrolls report was released at the start of August, surging above the 200DMA on Wednesday before taking out resistance overhead at 149.00 on Thursday. That level may now act as support, providing a potential base for longs to be established by those seeking an eventual retest of resistance at 151.00 or even 152.40.

RSI (14) and MACD are trending higher in bullish territory, painting a picture of strengthening upside pressure. That favours longs over shorts in the near term.

While the price and momentum picture is entirely bullish, recent stays above the 200DMA have proved fleeting for USD/JPY this year, underlining the need to be selective on entry levels for those playing the pair from the long side.